FinCEN Needs More Resources – and a TSV SAR Feedback Loop – To Really Make a Difference in the Fight Against Crime & Corruption

Every year each US federal government department and agency submits its Congressional budget justification and annual performance report and plan: essentially a document that says to Congress “here’s our mission, here’s how we did last year, here’s what we need for next year.” FinCEN’s fiscal year 2020 (October 1, 2019 through September 30, 2020) Congressional Budget Justification and Annual Performance Report and Plan is available at

https://home.treasury.gov/system/files/266/12.-FINCEN-FY-2020-CJ.pdf

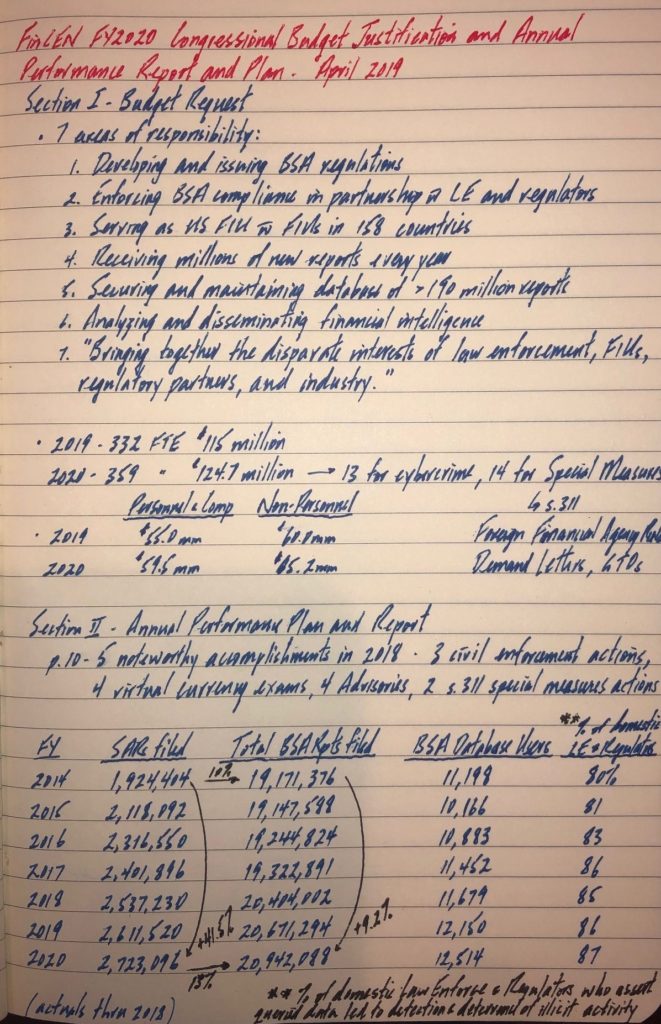

My notes on the 14-page document summarize some of the key aspects of the report.

First is a summary of what FinCEN does: its areas of responsibility. Of note is the seventh area – “bringing together the disparate interests of law enforcement, [158 foreign] FIUs, regulatory partners, and industry”. This is also an admission that the interests of the various public and private sector participants are, in fact, disparate. Which begs the questions “should there be disparate interests?” and “what can we do to bring all these participants together and forge a single, unified interest of safeguarding the financial system from illicit use, combating money laundering, and promoting national security through the strategic use of financial authorities and the collection, analysis, and dissemination of financial intelligence?” (quoting FinCEN’s mission statement). When it comes to fighting human trafficking, drug trafficking, etc., different perspectives are healthy and expected … competing or disparate interests are counterproductive.

Second, many people will be surprised at just how small FinCEN is – from the number of people to its overall budget – given the importance of its mission. The FY2019 budget called for 332 people and a budget of $115 million. The FY2020 budget proposes an increase to 359 people and a budget of $124.7 million, with the increase in people split between two priority programs: 13 for cybercrime, and 14 for “special measures”, which includes the actual special measures section (section 311) of the Patriot Act, requests to financial institutions for data on foreign financial institution wire transfers, and Geographic Targeting Orders. As a “participant” for 20+ years, I would like to see what FinCEN could do if it had 659 people and a budget of $224.7 million: perhaps the $100 million to fund FinCEN’s efforts to combat human trafficking, narcotics trafficking, and foreign corruption could come from a 2.8% reduction in the “new drone procurement” budget request of the Department of Defense …

Third, the data on SARs filed, total BSA reports filed, and BSA Database Users is interesting. From FY2014 through FY2018 (actuals) and through FY2020 (estimates), the number of SARs filed has gone from 1.9 million to 2.7 million, an increase of 41.5%. But in the same period, the total number of BSA reports filed – including SARs – has gone from 19.2 million to 20.9 million, an increase of only 9.2%. That tells us two things: SARs are estimated to make up about 1 out of every 8 BSA reports filed in FY2020 compared to 1 out of every 10 BSA reports filed in FY2014 (a positive trend); and the total number of non-SAR BSA filings has essentially been the same for the last 7 years. In other words, the number of CTRs, CMIRs, and FBARs is not going up.

Fourth, there is the axiomatic, reflexive gripe that the SAR database is a black-hole: that financial institutions file SARs then never hear anything back from FinCEN or law enforcement as to whether those SARs are meaningful, effective, useful. But look at the following from page 12:

FinCEN monitors the percentage of domestic law enforcement and regulators who assert queried BSA data led to detection and deterrence of illicit activity. This performance measure looks at the value of BSA data, such as whether the data provided unknown information, supplemented or expanded known information, verified information, helped identify new leads, opened a new investigation or examination, supported an existing investigation or examination, or provided information for an investigative or examination report. In FY 2018, FinCEN narrowly missed its target of 86 percent with 85 percent of users finding value from the data. FinCEN will work toward increasing its FinCEN Portal/FinCEN Query training efforts to provide more users with the knowledge needed in order to better utilize both FinCEN Portal and FinCEN Query. In FY 2019, the target is set at 86 percent and 87 percent in FY 2020.

Looking at this in a positive light, there appears to be a feedback loop between the users of BSA data – law enforcement and the regulators – and FinCEN, where law enforcement and regulators can assert – therefore they can determine – whether BSA data (mostly SARs and CTRs) led to detection and deterrence of illicit activity: whether the data provided unknown information, supplemented or expanded known information, verified information, helped identify new leads, opened a new investigation or examination, supported an existing investigation or examination, or provided information for an investigative or examination report.

The feedback loop between the users of BSA data (law enforcement, regulators, and FinCEN) must be expanded to include the producers (financial institutions) of BSA data

I have written previously about the need to provide financial institutions with more feedback on the 20 million+ BSA reports they produce every year. See, for example: https://regtechconsulting.net/uncategorized/rules-based-monitoring-alert-to-sar-ratios-and-false-positive-rates-are-we-having-the-right-conversations/

In that article, I introduced something I call the “TSV” SAR, or “Tactical or Strategic Value” SAR. I wrote:

How do you determine whether a SAR provides value to Law Enforcement? One way would be to ask Law Enforcement, and hope you get an answer. That could prove to be difficult. Can you somehow measure Law Enforcement interest in a SAR? Many banks do that by tracking grand jury subpoenas received to prior SAR suspects, Law Enforcement requests for supporting documentation, and other formal and informal requests for SARs and SAR-related information. As I write above, an Alert-to-SAR rate may not be a good measure of whether an alert is, in fact, “positive”. What may be relevant is an Alert-to-TSV SAR rate. What is a “TSV SAR”? A SAR that has Tactical or Strategic Value to Law Enforcement, where the value is determined by Law Enforcement providing a response or feedback to the filing financial institution within five years of the filing of the SAR that the SAR provided tactical (it led to or supported a particular case) or strategic (it contributed to or confirmed a typology) value. If the filing financial institution does not receive a TSV SAR response or feedback from law enforcement or FinCEN within five years of filing a SAR, it can conclude that the SAR had no tactical or strategic value to law enforcement or FinCEN, and may factor that into decisions whether to change or maintain the underlying alerting methodology. Over time, the financial institution could eliminate those alerts that were not providing timely, actionable intelligence to law enforcement, and when that information is shared across the industry, others could also reduce their false positive rates.

Tactical or Strategic Value (TSV) SAR Feedback Loop

It appears that there are already mechanisms in place for law enforcement and the regulators to determine whether the 20 million CTRs and SARs that are being filed every year provide unknown information, supplement or expand known information, verify information, help identify new leads, open a new investigation or examination, support an existing investigation or examination, or provide information for an investigative or examination report. There is a way – there is always a way if there is the will – to provide that information to the private sector filers of the CTRs and SARs. Perhaps there is a member of Congress out there that could tweak FinCEN’s Fiscal Year 2020 budget request a little bit to give it the people power and monetary resources to begin developing a TSV SAR Feedback loop. We’d all benefit.