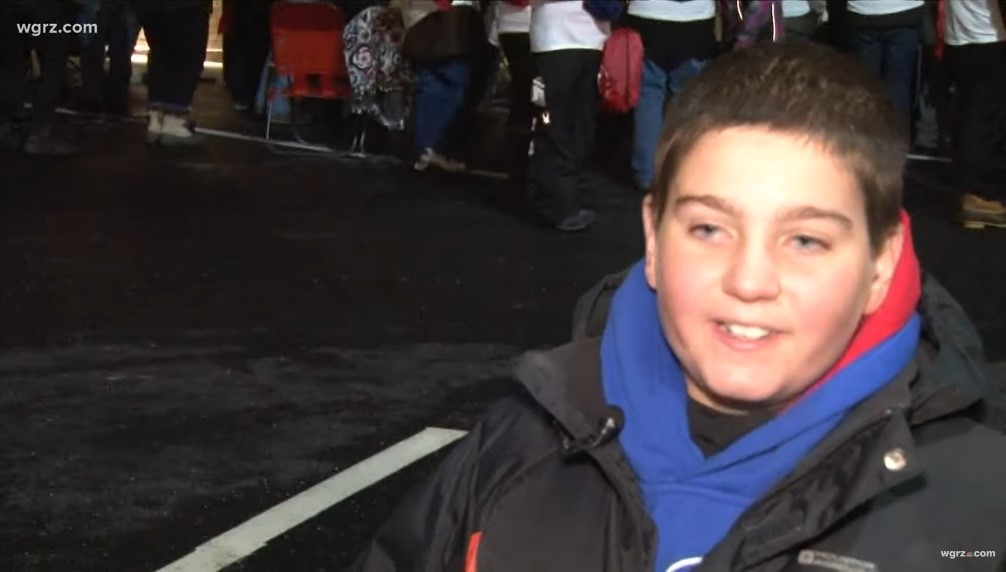

“Well, I’m here in the freezing cold getting’ free chicken sandwiches. Because the food tastes great. I mean, it’s chicken. Fried chicken. I like fried chicken.”

Eleven year-old Sam Caruana of Buffalo, New York waited outside a Chick-fil-A restaurant in the freezing cold in order to be one of the 100 people given free fried chicken for one year (actually, one chicken sandwich a week for fifty-two weeks). In a video that went viral (Sam Caruana YouTube – Free Chicken), young Sam explained that he simply loved fried chicken, and he’d stand in the cold for free fried chicken.

Just as Sam loves free fried chicken, law enforcement loves free Suspicious Activity Reports, or SARs. In the United States, over 30,000 private sector financial institutions – from banks to credit unions, to money transmitters and check cashers, to casinos and insurance companies, to broker dealers and investment advisers – file more than 2,000,000 SARs every year. And it costs those financial institutions billions of dollars to have the programs, policies, procedures, processes, technology, and people to onboard and risk-rate customers, to monitor for and identify unusual activity, to investigate that unusual activity to determine if it is suspicious, and, if it is, to file a SAR with the Treasury Department’s Financial Crimes Enforcement Network, or FinCEN. From there, hundreds of law enforcement agencies across the country, at every level of government, can access those SARs and use them in their investigations into possible tax, criminal, or other investigations or proceedings. To law enforcement, those SARs are, essentially, free. And like Sam loves free fried chicken, law enforcement loves free SARs. Who wouldn’t?

But should those private sector SARs, that cost billions of dollars to produce, be “free” to public sector law enforcement agencies? Put another way, should the public sector law enforcement agency consumers of SARs need to provide something in return to the private sector producers of SARs?

I say they should. And here’s what I propose: that in return for the privilege of accessing and using private sector SARs, law enforcement shouldn’t have to pay for that privilege with money, but with effort. The public sector consumers of SARs should let the private sector producers know which of those SARs provide tactical or strategic value.

A recent Mid-Size Bank Coalition of America (MBCA) survey found the average MBCA bank had: 9,648,000 transactions/month being monitored, resulting in 3,908 alerts/month (0.04% of transactions alerted), resulting in 348 cases being opened (8.9% of alerts became a case), resulting in 108 SARs being filed (31% of cases or 2.8% of alerts). Note that the survey didn’t ask whether any of those SARs were of interest or useful to law enforcement. Some of the mega banks indicate that law enforcement shows interest in (through requests for supporting documentation or grand jury subpoenas) 6% – 8% of SARs.

I argue that the Alert/SAR and even Case/SAR ratios are all of interest, but tracking to SARs filed is a little bit like a car manufacturer tracking how many cars it builds but not how many cars it sells, or how well those cars perform, how long they last, and how popular they are. And just like the automobile industry measuring how many cars are purchased, the better measure for AML programs is “SARs purchased”, or SARs that provide value to law enforcement.

Also, there is much being written about how machine learning and artificial intelligence will transform anti-money laundering programs. Indeed, ML and AI proponents are convinced – and spend a lot of time trying to convince others – that they will disrupt and revolutionize the current “broken” AML regime. Among other targets within this broken regime is AML alert generation and disposition and reducing the false positive rate. The result, if we believe the ML/AI community, is a massive reduction in the number of AML analysts that are churning through the hundreds and thousands of alerts, looking for the very few that are “true positives” worthy of being labelled “suspicious” and reported to the government. But the fundamental problem that every one of those ML/AI systems has is that they are using the wrong data to train their algorithms and “teach” their machines: they are looking at the SARs that are filed, not the SARs that have tactical or strategic value to law enforcement.

Tactical or Strategic Value Suspicious Activity Reports – TSV SARs

The best measure of an effective and efficient financial crimes program is how well it is providing timely, effective intelligence to law enforcement. And the best measure of that is whether the SARs that are being filed are providing tactical or strategic value to law enforcement. How do you determine whether a SAR provides value to law enforcement? One way would be to ask law enforcement, and hope you get an answer. That could prove to be difficult. Can you somehow measure law enforcement interest in a SAR? Many banks do that by tracking grand jury subpoenas received to prior SAR suspects, law enforcement requests for supporting documentation, and other formal and informal requests for SARs and SAR-related information. As I write above, an Alert-to-SAR rate may not be a good measure of whether an alert is, in fact, “positive”. What may be relevant is an Alert-to-TSV SAR rate.

A TSV SAR is one that has either tactical value – it was used in a particular case – or strategic value – it contributed to understanding a typology or trend. And some SARs can have both tactical and strategic value. That value is determined by law enforcement indicating, within seven years of the filing of the SAR (more on that later), that the SAR provided tactical (it led to or supported a particular case) or strategic (it contributed to or confirmed a typology) value. That law enforcement response or feedback is provided to FinCEN through the same BSA Database interfaces that exist today – obviously, some coding and training will need to be done (for how FinCEN does it, see below). If the filing financial institution does not receive a TSV SAR response or feedback from law enforcement or FinCEN within seven years of filing a SAR, it can conclude that the SAR had no tactical or strategic value to law enforcement or FinCEN, and may factor that into decisions whether to change or maintain the underlying alerting methodology. Over time, the financial institution could eliminate those alerts that were not providing timely, actionable intelligence to law enforcement. And when FinCEN shares that information across the industry, others could also reduce their false positive rates.

FinCEN’s TSV SAR Feedback Loop

FinCEN is working to provide more feedback to the private sector producers of BSA reports. As FinCEN Director Ken Blanco recently stated:[1]

“Earlier this year, FinCEN began the BSA Value Project, a study and analysis of the value of the BSA information we receive. We are working to provide comprehensive and quantitative understanding of the broad value of BSA reporting and other BSA information in order to make it more effective and its collection more efficient. We already know that BSA data plays a critical role in keeping our country strong, our financial system secure, and our families safe from harm — that is clear. But FinCEN is using the BSA Value Project to improve how we communicate the way BSA information is valued and used, and to develop metrics to track and measure the value of its use on an ongoing basis.”

FinCEN receives every SAR. Indeed, FinCEN receives a number of different BSA-related reporting: SARs, CTRs, CMIRs, and Form 8300s. It’s a daunting amount of information. As FinCEN Director Ken Blanco noted in the same speech:

FinCEN’s BSA database includes nearly 300 million records — 55,000 new documents are added each day. The reporting contributes critical information that is routinely analyzed, resulting in the identification of suspected criminal and terrorist activity and the initiation of investigations.

“FinCEN grants more than 12,000 agents, analysts, and investigative personnel from over 350 unique federal, state, and local agencies across the United States with direct access to this critical reporting by financial institutions. There are approximately 30,000 searches of the BSA data taking place each day. Further, there are more than 100 Suspicious Activity Report (SAR) review teams and financial crimes task forces across the country, which bring together prosecutors and investigators from different agencies to review BSA reports. Collectively, these teams reviewed approximately 60% of all SARs filed.

Each day, law enforcement, FinCEN, regulators, and others are querying this data: 7.4 million queries per year on average. Those queries identify an average of 18.2 million filings that are responsive or useful to ongoing investigations, examinations, victim identification, analysis and network development, sanctions development, and U.S. national security activities, among many, many other uses that protect our nation from harm, help deter crime, and save lives.”

This doesn’t tell us how many of those 55,000 daily reports are SARs, but we do know that in 2018 there were 2,171,173 SARs filed, or about 8,700 every (business) day. And it appears that FinCEN knows which law enforcement agencies access which SARs, and when. And we now know that there are “18.2 million filings that are responsive or useful to ongoing investigations, examinations, victim identification, analysis and network development, sanctions development, and U.S. national security activities” every year. But which filings?

The law enforcement agencies know which SARs provide tactical or strategic value, or both. So if law enforcement finds value in a SAR, it should acknowledge that, and provide that information back to FinCEN. FinCEN, in turn, could provide an annual report to every financial institution that filed, say, more than 250 SARs a year (that’s one every business day, and is more than three times the number filed by the average bank or credit union). That report would be a simple relational database indicating which SARs had either or both tactical or strategic value. SAR filers would then be able to use that information to actually train or tune their monitoring and surveillance systems, and even eliminate those alerting systems that weren’t providing any value to law enforcement.

Why give law enforcement seven years to respond? Criminal cases take years to develop. And sometimes a case may not even be opened for years, and a SAR filing may trigger an investigation. And sometimes a case is developed and the law enforcement agency searches the SAR database and finds SARs that were filed five, six, seven or more years earlier. Between record retention rules and practical value, seven years seems reasonable.

Law enforcement agencies have tremendous responsibilities and obligations, and their resources and budgets are stretched to the breaking point. Adding another obligation – to provide feedback to the banks, credit unions, and other private sector institutions that provide them with reports of suspicious activity – may not be feasible. But the upside of that feedback – that law enforcement may get fewer, but better, reports, and the private sector institutions can focus more on human trafficking, human smuggling, and terrorist financing and less on identifying and reporting activity that isn’t of interest to law enforcement – may far exceed the downside.

Free Suspicious Activity Reports are great. But like Sam being prepared to stand in the freezing cold for his fried chicken, perhaps law enforcement is prepared to let us know whether the reports we’re filing have value.

For more on alert-to-SAR rates, the TSV feedback loop, machine learning and artificial intelligence, see other articles I’ve written:

The TSV SAR Feedback Loop – June 4 2019

AML and Machine Learning – December 14 2018

Rules Based Monitoring – December 20 2018

FinCEN FY2020 Report – June 4 2019

FinCEN BSA Value Project – August 19 2019

BSA Regime – A Classic Fixer-Upper – October 29 2019

[1] November 15, 2019, prepared remarks for the Chainalysis Blockchain Symposium, available at https://www.fincen.gov/news/speeches/prepared-remarks-fincen-director-kenneth-blanco-chainalysis-blockchain-symposium