In the last two years, the percentage of banks actively banking (federally illegal and unregulated) marijuana related businesses (MRBs) has gone from 5% to more than 10% – why do we need Congress to interfere? Our experience with (federally legal and regulated) money services businesses (MSBs) shows that relief is hard to come by … and may not dramatically increase the number of banks willing to take on MRBs.

I have written three articles on FinCEN’s quarterly “marijuana banking update”. The most recent, published on June 25, 2019, is available at Richards article on FinCEN MRB reports. Those reports, published by FinCEN since 1Q 2017 and tracking marijuana-related Suspicious Activity Reports (SARs) filed since the FinCEN guidance was published in February 2014, show two broad categories of data: (1) the total number of banks and credit unions that are “actively banking marijuana related businesses”; and (2) the number of each of the three types of SARs that FinCEN has directed financial institutions to file: Marijuana Limited, Marijuana Priority, and Marijuana Termination. I won’t describe what type of activity each type of SAR is meant to report, as the descriptions in the quarterly updates are inconsistent with the actual 2014 guidance. You’ll have to read the articles to find out about those inconsistencies.

I’ve also written about the proposed SAFE Banking Act – Richards article on SAFE Banking Act – which is the Democratic-controlled House of Representatives’ attempt at getting a federal law passed to give financial institutions some comfort that they simply by knowingly providing financial services to (what the bill describes as) “cannabis related legitimate businesses” and “service providers”, they won’t be sanctioned by their regulatory agencies.

Let’s put those two things together – FinCEN’s quarterly updates on the number of banks and credit unions “actively banking marijuana related businesses”, and the push in Congress (or at least one of the two chambers of Congress) to pass a law to encourage banks and credit unions to knowingly provide financial services to the federally illegal and unregulated “cannabis related legitimate businesses” and their “service providers”.

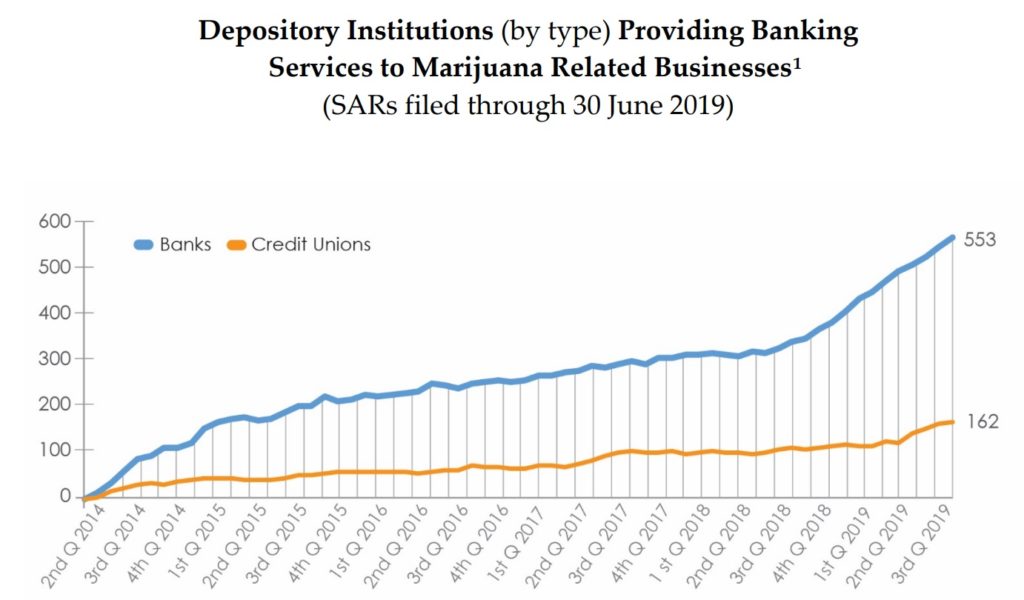

The most recent (June 2019) FinCEN update is available at FinCEN 2Q 2019 MRB Update. It shows that as of June 30, 2019, there were 553 banks and 162 credit unions “actively banking marijuana related businesses.” (I have put this phrase in quotes because industry experts believe that the number of banks and credit unions that are actively, knowingly providing depository or transactional services to licensed cannabis or marijuana businesses is much less than what FinCEN reports … and closer to 50 than 715. But let’s go with what FinCEN has been publishing.). The slow but steady increase in the number of banks and credit unions providing banking services to MRBs is shown in the FinCEN chart below:

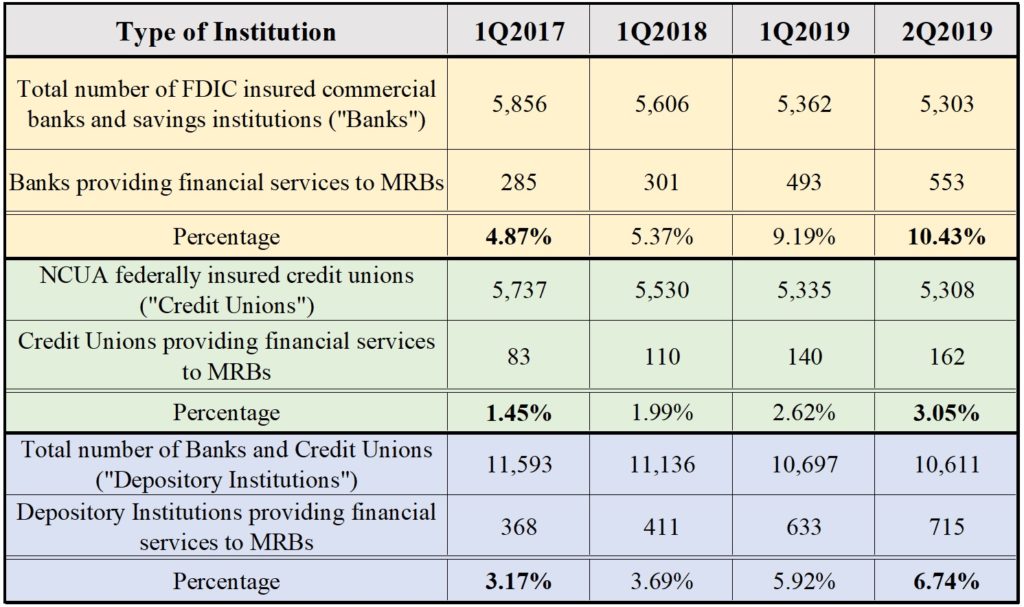

What is not shown, though, is the percentage of banks and credit unions that are providing financial services to marijuana related businesses. Using data provided by the FDIC, which insures all commercial banks and savings institutions, and the NCUA, which insures all credit unions, we can see that (1) the total number of banks and credit unions has been falling, while (2) the total number of banks and credit unions that are providing banking services to MRBs has more than doubled in the last two years:

The total number of banks and credit unions has been dropping over the last 2+ years (by about 9%), while the total number of banks and credit unions providing financial services to MRBs has been going up (by almost 200%). The result is that as of June 2019, about one in ten federally insured banks and more than one in sixteen depository institutions overall, are, according to the Treasury Department, “actively banking marijuana related businesses”. It’s perplexing why relatively so few credit unions are engaged in the MRB space.

Which begs the question: if the percentage of depository institutions actively banking marijuana related business has more than doubled in the last two years, and if one in ten federally insured banks and more than one in sixteen depository institutions overall, are actively banking marijuana related businesses, do we even need Congress to intervene and pass new laws to encourage those depository institutions? New laws mean new regulations. New regulations certainly mean new regulatory guidance and expectations, and probably mean more government expense and oversight.

A fair argument can be made that if only 10% of banks and 3% of credit unions are actively banking marijuana related businesses, we absolutely need Congress (and the President) to step in and pass a law or laws to encourage more banks and credit unions to participate in the marijuana/cannabis industry. But even if a SAFE Banking Act, or equivalent, is passed by Congress and signed into law by the President, regulations and regulatory guidance will still need to be published and written, and banks and credit unions will still need to have a risk-based program with the panoply of required preventative and detective controls. Those programs are expensive to build, more expensive to maintain, and bring uncertain regulatory, legal, and reputational risk to the institution. And, of course, MRBs will still be federally illegal, and remain unregulated by any federal agencies.

Money Services Businesses (MSBs) – a lesson for banking Marijuana Related Businesses (MRBs)?

Money Services Businesses, or MSBs (check cashers, money transmitters, currency exchangers) are all perfectly legal, state-licensed, federally-registered financial institutions that, since 2002 have been required to have their own BSA/AML compliance programs and to report suspicious activity. Just like banks and credit unions. And in March 2005 the financial services regulators issued guidance to the industry on how to provide banking services to MSBs. The FinCEN press release provided the following explanation:

“The Financial Crimes Enforcement Network (“FinCEN”), together with the Board of Governors of the Federal Reserve System, the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation, the Office of Thrift Supervision, and the National Credit Union Administration (collectively, the “Federal Banking Agencies”) are jointly issuing this Statement to address our expectations regarding banking institutions’ obligations under the Bank Secrecy Act for money services businesses, such as check cashers and money transmitters. Money services businesses are losing access to banking services as a result of concerns about regulatory scrutiny, the risks presented by money services business accounts, and the costs and burdens associated with maintaining such accounts. Concerns may stem, in part, from a misperception of the requirements of the Bank Secrecy Act, and the erroneous view that money services businesses present a uniform and unacceptably high risk of money laundering or other illicit activity.”

Notwithstanding that MSBs are legal businesses, are federally-regulated, and the regulators have encouraged banks to provide financial services to them, the vast majority of financial institutions today will not bank MSBs. Why? The real or perceived regulatory burdens are too onerous, and the regulatory, legal, and reputational risks are too great. There may be some data on what percentage of banks and credit unions are knowingly, actively banking MSBs, but I haven’t seen it. Anecdotes suggest that less than one in five banks and credit unions have an MSB banking program and are knowingly, actively providing depository and transactional services for MSBs.

So if less than one in five depository institutions are banking federally legal and regulated Money Services Businesses more than fifteen years after given a Congressional “green light”, and if the percentage of depository institutions banking federally illegal and unregulated Marijuana Related Businesses has more than doubled in the last two years to one in sixteen … do we really need Congress to pass a law encouraging depository institutions to bank these illegal, unregulated businesses, or do we simply wait until marijuana is federally legal, and then regulate the marijuana industry … hopefully better than we’ve done with the money services industry?

In December 2018 I proposed an idea to provide relief to depository institutions looking at knowingly, actively providing financial services to MRBs: have the regulatory agencies publish guidance that would treat MRBs like MSBs. The idea was simple … replace the terms “money services business” and “MSB” in the interagency 2005 guidance on MSBs, with “marijuana related business” and “MRB”. At least we might find that 20% of banks and credit unions would be able to balance the meager rewards with the uncertain risks and provide financial services to marijuana related businesses. See Richards – 2005 MSB Guidance = 2019 MRB Guidance