Crypto Rating Council

A group of crypto financial services firms and exchanges have formed the Crypto Rating Council, or CRC “to create a framework to consistently and objectively assess whether any given crypto asset has characteristics that make it more or less likely to be classified as a security under the U.S. federal securities laws.” See their website at https://www.cryptoratingcouncil.com/#about-us

The founding members of the Crypto Rating Council are Anchorage, Bittrex, Circle Financial, Coinbase, Cumberland, Genesis, Grayscale, and Kraken.

According to the website:

“The important question of whether any given digital asset is a security—as opposed to a commodity, a currency, or something else—informs critical licensing, registration, and operating obligations for financial services firms that support cryptocurrency. The U.S. Securities & Exchange Commission has issued guidance that some crypto assets may be securities while others may not be.”

That guidance began with a Report of Investigation the SEC released in 2017 – https://www.sec.gov/litigation/investreport/34-81207.pdf and continued with Guidance on Initial Coin Offerings published on April 3, 2019 – https://www.sec.gov/news/public-statement/statement-framework-investment-contract-analysis-digital-assets

As the CRC notes:

“While the SEC’s guidance has been helpful in alerting the industry to complex legal issues, determining whether any particular token is a security remains highly circumstantial and difficult to resolve even with the help of leading legal and technical experts. This complexity has led to expensive, redundant, and frequently inconsistent compliance analysis among financial services firms and has generally slowed the launch of new cryptocurrency assets in the U.S.”

And

“The question of whether a crypto asset is a security—as opposed to a currency, a commodity, or something else—may trigger registration, licensing, and other operating obligations for financial services firms that offer digital asset services like exchange, investment management, and trading. Under federal U.S. law, this important question is generally answered by applying the four-factor Howey test, which requires painstaking “facts and circumstances” analysis which often leads to judgment calls, inconsistent results, and can lead to disagreement among legal experts (and government officials). The founding members formed the CRC to create a compliance tool which, in partnership with securities law experts, allows the members to consistently review assets supported in the ordinary course of their respective businesses.”

In addition to slowing the launch of new cryptocurrency assets in the US, there have been dozens (hundreds) of digital asset/ICO enforcement actions filed by the SEC. A list of those actions is available at https://www.sec.gov/spotlight/cybersecurity-enforcement-actions

So, as a result of this confusion, the Crypto Rating Council was formed “to create a framework to consistently and objectively assess whether any given crypto asset has characteristics that make it more or less likely to be classified as a security under the U.S. federal securities laws.”

The Securities Rating Framework

According to the CRC, its securities rating framework is “a points-based rating system built upon a set of factual questions that assess each element of the legal test to determine whether an asset is a security. Our framework is derived directly from case law and SEC guidance and has been structured to emphasize objective, repeatable, and fact-driven responses that can be answered more consistently across different assets and across the same asset over time.”

In its FAQs section, the CRC described its securities rating framework as follows:

“At the core of the Council’s work is a points-based rating system centered around a set of factual questions. Working with legal and technical experts and members of the community, the CRC distilled a set of yes or no questions which are designed to plainly address each of the four, Howey test factors: (i) whether crypto purchasers invested money, (ii) in a “common enterprise”, (iii) with a reasonable expectation of profit, (iv) based on the efforts of others. The questions are tailored to assess the characteristics most likely to impact any given crypto asset’s treatment under the securities laws. These characteristics include circumstances of the asset’s issuance, governance features, third-party contributions to the project, and practical use of the asset by the general public. The questions are also structured to allow for objective, repeatable, and fact-driven responses that can be answered consistently across different assets and across the same asset over time.”

The Rating Explained

Again, according to the FAQs:

“Each question in the framework is assigned a points-based weighting to reflect its relative importance, the sum of which create scores for each Howey factor. Those scores are then scaled into a final rating between 1 and 5. A score of 5 results when an asset appears to have many characteristics that are consistent with the Howey-test factors. It is probably more likely, relative to lower-scored assets, to implicate the U.S. securities laws. A score of 1 results when an asset appears to have few characteristics that are consistent with the Howey-test factors. It is probably less likely, relative to higher-scored assets, to implicate the U.S. securities laws.”

How Did The Cryptocurrencies Fare Under the Rating System?

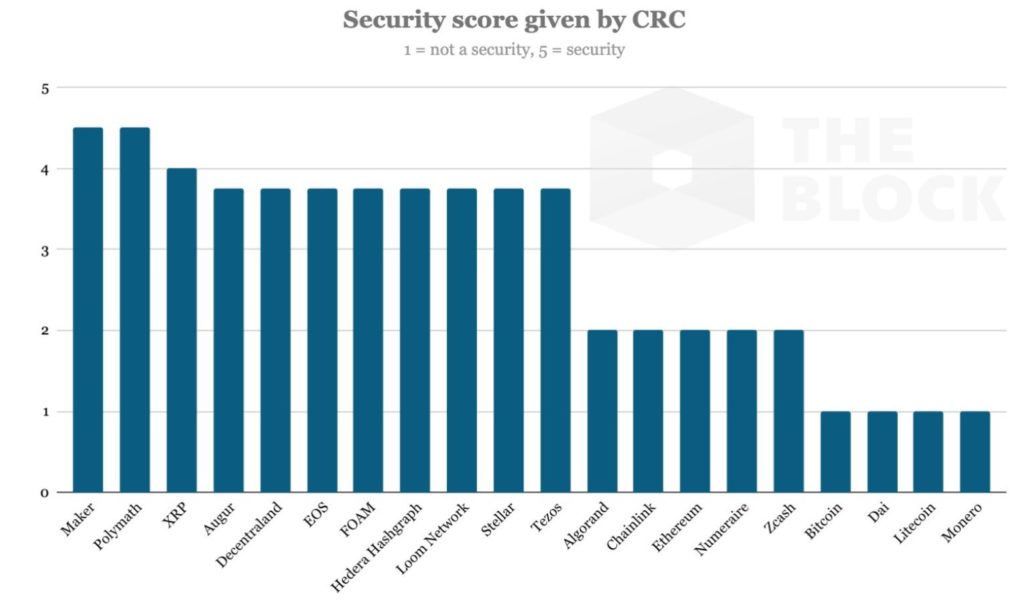

A useful graph published online (is “published online” necessary in 2019, or will “published” suffice?) by TheBlockCrypto.com provides the results of the CRC’s first efforts:

We can spotlight three of these to see how the scores were determined at a high level: Bitcoin at 1.00 (definitely not a security), Ethereum at 2.00 (probably not a security), and XRP at 4.00 (likely to be a security).