I previously wrote about the FinCEN quarterly Marijuana Banking Report in an article published August 26, 2018: August 26, 2018 Article

The FinCEN Report is available at FinCEN Marijuana Banking Report.

FinCEN appears to be doing its best with the limited resources that the Administration has allocated and Congress has provided. If properly resourced with the needed technology, capability, and staffing resources, I expect that FinCEN could do much more with the valuable information that the 633 depository institutions are providing through the 81,725 marijuana-related SARs they have filed over the last 5 years. Here’s hoping that the Administration and Congress step up.

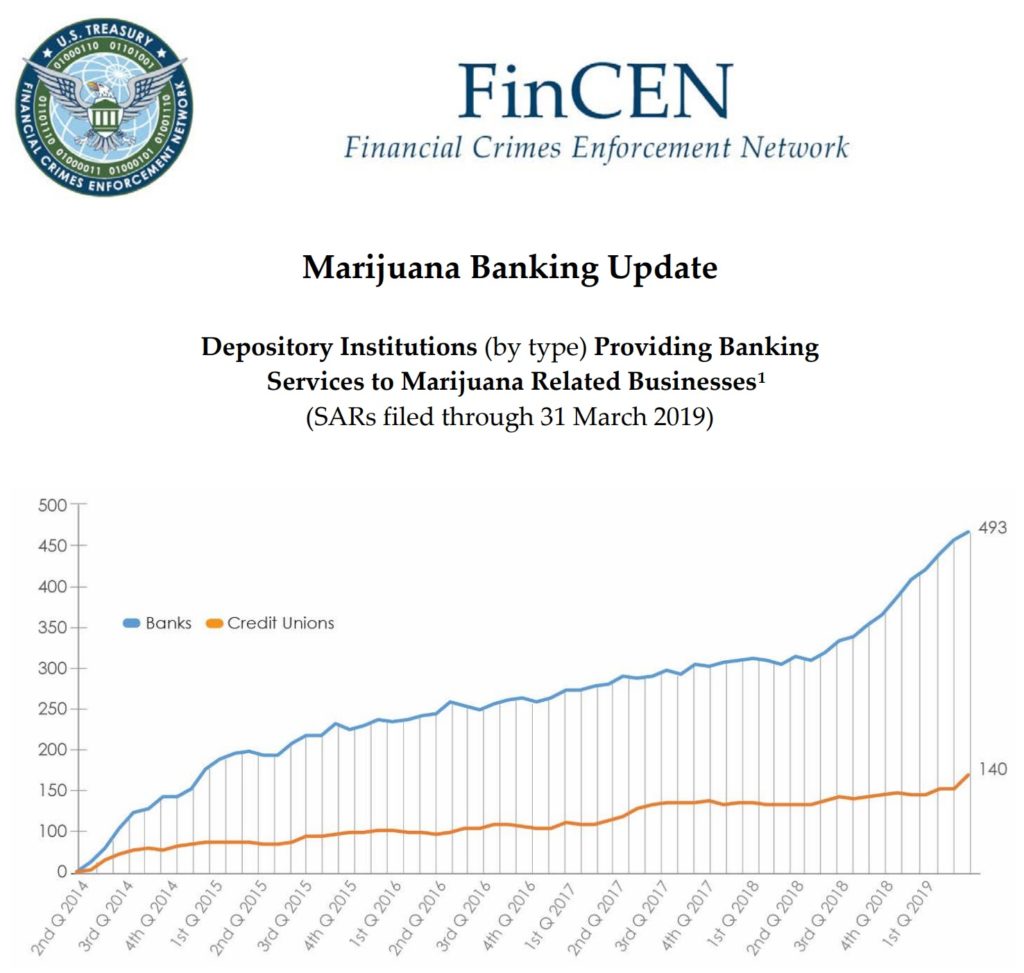

Until those resources are deployed, it appears that the public will continue to receive some good data through the quarterly Marijuana Banking Reports, but not much usable information. The raw data that was provided indicates that since the FinCEN Guidance introduced the “marijuana-related SAR” concept in February 2014, 493 banks and 140 credit unions have filed one or more of the three types of marijuana-related SARs. Leaving aside what constitutes each of the three types of marijuana-related SARs (the quarterly Marijuana Report doesn’t accurately describe the three types, as I discuss below), FinCEN reports that 81,725 marijuana-related SARs have been filed since Q2 2014. That is good data, but it would be useful information if, for example, that number was compared to the total number of SARs filed by depository institutions in the same period of time (according to FinCEN’s SAR data, that is 4,653,076 SARs) so that we would know that marijuana-related SARs make up 1.76% of all depository institution SARs and are being filed by about 5% of all depository institutions. Other examples of useful and useable (actionable) information include:

Actionable Information

- The size and locations of the banks and credit unions filing the marijuana SARs

- The locations of the Marijuana Related Businesses (MRBs)

- Whether the activity involves medicinal/medical or recreational/adult-use MRBs

- The types of MRBs: growers/cultivators, producers, manufacturers, distributors, testing labs, retailers, dispensaries

- How many MRBs are being reported and why

- Whether the MRBs are part of larger, national (or even international) companies that are coming to dominate the US cannabis industry.

- The types of marijuana-related SARs the banks and credit unions are filing: for example, how many banks are only filing Marijuana-Termination SARs, how many of the Marijuana-Limited SARs are 90-day follow-ups rather than net new customers.

- Quarter-over-quarter and year-over-year trends: e.g., from Q4 2018 to Q1 2019, the total number of marijuana-related SARs is up 12% but Marijuana Termination SARs are up 14% … what is FinCEN seeing in those filings that could be useful for depository institutions considering whether to provide banking services to MRBs?

- There are ten times as many Marijuana Limited SARs (61,036) as there are Marijuana Priority SARs (6,067), and three times as many Marijuana Limited SARs as Marijuana Termination SARs (19,368): why is that? How many of the Marijuana Limited SARs are “continuing activity” SARs (where FinCEN has instructed financial institutions to file a marijuana-related SAR every 90 days regardless of the nature of the activity)?

- Whether, and to what extent, the voluntary information sharing provisions of 314(b) and 31 CFR 101.540 are being used by these institutions?

Banks and Credit Unions Aren’t the Only SAR Filers, and What About Marijuana-related CTRs?

There are two other limitations on the Marijuana Banking Report that stand out to me.

First, the Report is limited to banks and credit unions, which, for FinCEN’s reporting purposes, are collectively “Depository Institutions”. Overall, Depository Institutions filed about 45% of all SARs in 2018: MSBs filed 40%, casinos filed about 2.5%, Broker/Dealers filed about 1.2%, and “Other” filed about 11%. It would be instructive to know what other reporting entities are filing marijuana-related SARs.

Second, the original FinCEN Guidance also referred to the two primary large cash transaction reports: CTRs for financial institutions and Form 8300s for non-financial trades and businesses. It would be instructive to know how many of these reports are filed on known marijuana related businesses (linkages between SAR data and CTR/Form 8300 data can be made by TIN or other identifiers on conductors and beneficiaries of the cash transactions).

The Quarterly Marijuana Banking Reports Misstate the 2014 Guidance

In addition, FinCEN should consider “cleaning up” the report. I re-offer (having originally offered in August 2018) four suggestions.

First, when describing the three marijuana SAR categories (Limited, Priority, and Termination), FinCEN refers to Cole Memo “red flags” … but none of the three Cole Memos (or the Ogden Memo) have any “red flags”. The red flags are actually set out in the FinCEN guidance – and there are 23 red flags to consider – and that original guidance correctly refers to the Cole Memo “priorities” when describing the three marijuana SAR types. Although some may quibble with my distinction, the term “red flags” is a red flag for banking auditors and regulators … the Cole Memo has priorities, the FinCEN guidance has red flags.

Second, footnote 1 of this Report describes when to use each of the three marijuana SAR types. For the marijuana “Termination” SAR, FinCEN indicates that it is to be used when the financial institution has decided to terminate its relationship with the MRB because (1) the financial institution “has decided not to have marijuana related customers for business reasons” or (2) the MRB is not fully compliant with the appropriate state’s marijuana regulations, or (3) the MRB raises one or more of the Cole Memo red flags. (Note the use of the alternative “or”). This language is different than the 2014 guidance, which has nothing about deciding not to have marijuana related customers for business reasons. I would like to see FinCEN provide the industry with guidance for not only exiting MRBs, but also about simply not providing banking services to marijuana related customers for business/risk reasons. It is clearly needed if less than 650 of more than 11,000 banks and credit unions are knowingly or unknowingly providing banking services to MRBs.

Third, there is nothing in the 2014 guidance, nor in the FinCEN Marijuana Banking report, that defines a “marijuana related business”. It is certainly implied that to be an MRB requires being subject to state marijuana regulations, but clear guidance would be helpful. Also, there are many businesses that do not have to be licensed and are not governed by state marijuana regulations, but are indirectly dealing with MRBs. Footnote 7 of the 2014 guidance referred to indirect services (“a financial institution could be providing services to a non-financial customer that provides goods or services to a marijuana-related business (e.g., a commercial landlord that leases property to a marijuana-related business). In such circumstances where services are being provided indirectly, the financial institution may file SARs based on existing regulations and guidance without distinguishing between “Marijuana Limited” and “Marijuana Priority.”): but it did not differentiate between (what I’ll call) Direct MRBs (those that are required to be licensed under state marijuana regulations) and Indirect MRBs (those that capital, services, products, property to Direct MRBs).

Finally, the Marijuana Banking Report describes the marijuana Limited-Priority-Termination SAR categories as “three phases for describing a financial institution’s relationship to marijuana-related businesses.” That isn’t accurate: there is not a progression or phasing of these categories, and the original 2014 guidance didn’t describe them that way. A bank or credit union (or any filer) doesn’t have to start with a Limited SAR, then progress to a Priority SAR, then end with a Termination SAR: they are three distinct SARs, dependent on the circumstances of each case.

The Marijuana Data Is Good, But Actionable Information Would Be Better!