US v Li et al, CD CA 19-MJ-00867

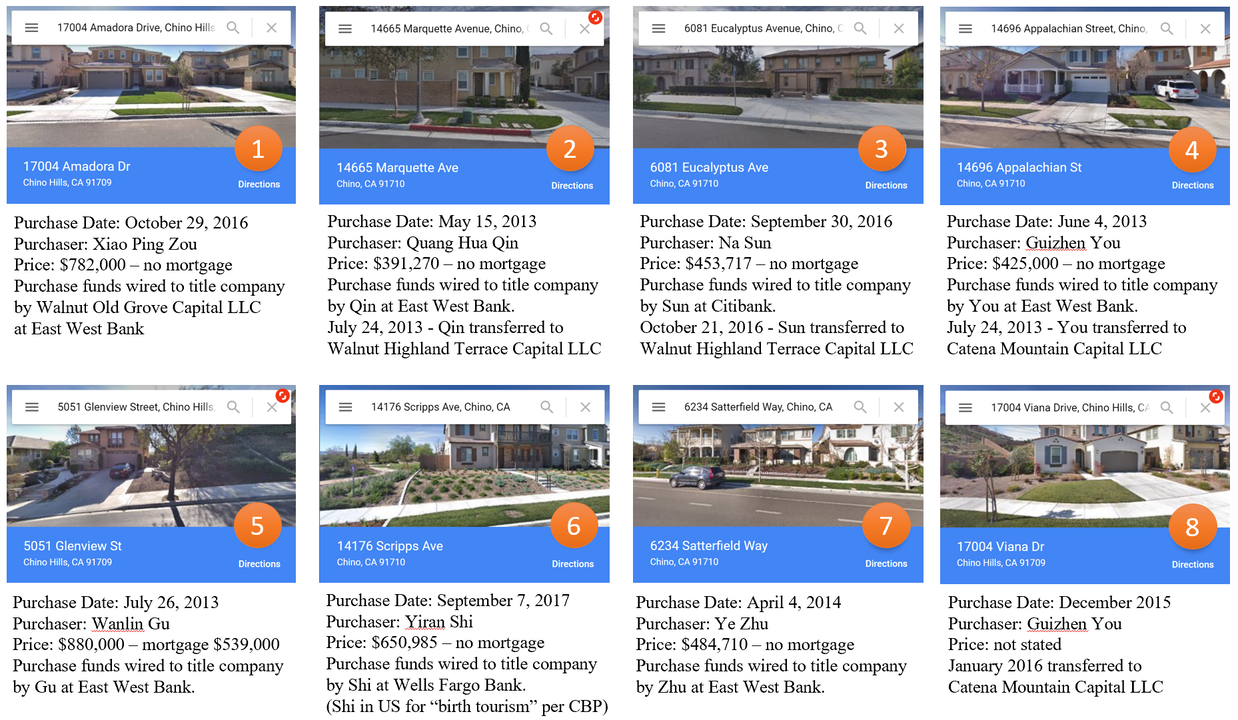

On March 7th the US Attorney for the Central District of California announced the arrests of three men for running an illegal marijuana grow and distribution operation out of eight homes in San Bernardino County.

This case reads like an ACAMS or ACFCS exam question, with even dollar wires from China, cash purchases of homes by straw buyers, linked shell companies, false leases, even border searches of cell phones (yes, when you enter the United States the Government can not only search your luggage, it can search your cell phone and laptop).

You may be asking yourself – if the homes were purchased with “all cash”, were they covered under FinCEN’s real estate-related Geographic Targeting Orders (GTOs)? The four GTOs require title insurance companies to report all cash purchases by legal entities of residential real estate over $300,000 in certain markets. The original January 2016 GTO affected only Miami and New York (and properties over $1 million in Miami and $3 million in New York). The GTO was renewed and expanded in July 2016 to cover LA County (properties over $2 million), and in November 2018 the GTO was expanded to twelve cities/counties and in all twelve the purchase price was set at $300,000.

Were any of these properties covered by the GTOs? No. San Bernardino County isn’t covered, and all eight properties were originally purchased by individuals. Even if San Bernardino County was covered, the four that were transferred to LLCs were all in amounts below the $2 million threshold and before the threshold was reduced to $300,000 in November 2018.

What if real estate agents had BSA/AML reporting requirements? Would the real estate agents in these deals recognized any red flags? No. One real estate agent handled all eight transactions: he is the lead defendant and set up the straw buyers, shell companies, etc.

The press release included the following quote from United States Attorney Nick Hanna: “In states that have decriminalized marijuana, we have seen an influx of foreign money used to establish grow operations, with much of the marijuana being destined for out-of-state consumers”. But seven of the eight properties used as grow houses were purchased before California passed the November 2016 proposition approving adult-use cannabis, and seven of the eight were set up as grow operations before the adult-use cannabis regime began in January 2018. However, there may be a connection to the adult-use cannabis regime: the first grow operation began in November 2016, then the next six were set up between August and October 2017. It appears that the defendant Li (through his wife) bought a house in September 2016 and immediately converted it to a grow operation (house #3 above). Once that was running, he then took six houses that had been purchased by Chinese nationals between 2013 and 2015, perhaps as investments and as means to get funds out of China and that were sitting empty, and converted them to grow operations.

There is no indication in the criminal complaint – which runs 120 pages – that the named banks identified any of the activity and filed Suspicious Activity Reports. There were certainly red flags aplenty:

- Newly established LLC account received four incoming wire transfers from a Guangdong, China trading company in a one month period for $199,960.13, $299,960.13, $249,960.13, and $349,960.14;

- Newly established personal account for a Chinese national on a tourist visa received nine incoming wires in a two week period, all at or just under the $50,000 limit on individual transfers from China and all referencing “tuition” or “education training”. Less than two weeks after the last wire, the account holder wired the funds to a title company and received a “second home” mortgage from the same bank;

- Newly established personal account for a Chinese national on a temporary visa, opened with a $15 deposit, received two incoming wires from a Chinese company for more than $300,000 each in a five-day period, immediately followed by a $10,000.00 payment to a title company; and

- A Chinese national with an account in a US bank received four incoming wires from her account at a Hong Kong bank within six days for $120,000.00, $110,000.00, $120,000.00, and $100,000.00 followed two days later by a wire transfer for $445,000.000 to a title company.

A careful review of the LLCs shows that there are common addresses (including mail drops at UPS Stores), and common managers, agents for service of process, and officers. However, all of the activity occurred prior to May 11, 2018, so the beneficial ownership rule was not yet in force.

#cannabisgrows #beneficialowner #strawbuyer #shellcompany

(Note: as of March 14 the case is not available on PACER)