In January 2018, Attorney General Sessions “revoked Obama-era guidance that had effectuated a hands-off approach to state-legalized cannabis businesses.”

This quote from an online National Law Journal article (see https://www.law.com/nationallawjournal/2018/09/11/feds-should-be-banging-the-drum-the-loudest-for-cannabis-industry-banking/?slreturn=20180812164053) and others like it, have been used by both (all?) sides of the marijuana argument currently embroiling America.

But what, exactly, did AG Sessions revoke? Was there a “hands-off approach” by the Feds to state-legalized cannabis businesses? And what does the Sessions memo do, if anything, for financial institutions looking to provide services to marijuana-related businesses?

If there are answers to those questions, we need to first go back almost 10 years to the first DOJ memo on marijuana. But an interim stop is warranted, to March 2017 with President Trump’s Executive Order 13777 calling for federal agencies to establish Regulatory Reform Task Forces to identify regulations for potential repeal, replacement, or modification. At that time the President, and (fairly) some others felt that American society was over-regulated. It was time to take a look at all the regulations, and repeal, replace, or modify. In response, the Department of Justice formed its task force and began its work identifying regulations, rules, and anything that looked like and acted like a regulation or rule.

On November 17, 2017 the DOJ task force’s early work was made public, when the Attorney General issued a memo prohibiting the DOJ from issuing so-called guidance memos going forward and providing notice that a DOJ task force would be looking at existing memos to recommend candidates for repeal or modification. This memo-against-memos provided, in part:

Today, in an action to further uphold the rule of law in the executive branch, Attorney General Jeff Sessions issued a memo prohibiting the Department of Justice from issuing guidance documents that have the effect of adopting new regulatory requirements or amending the law. The memo prevents the Department of Justice from evading required rulemaking processes by using guidance memos to create de facto regulations.

In the past, the Department of Justice and other agencies have blurred the distinction between regulations and guidance documents. Under the Attorney General’s memo, the Department may no longer issue guidance documents that purport to create rights or obligations binding on persons or entities outside the Executive Branch.

The Attorney General’s Regulatory Reform Task Force, led by Associate Attorney General Brand, will conduct a review of existing Department documents and will recommend candidates for repeal or modification in the light of this memo’s principles.

On December 21, 2017 the Attorney General announced that “pursuant to Executive Order 13777 and his November memorandum prohibiting certain guidance documents, he is rescinding 25 such documents that were unnecessary, inconsistent with existing law, or otherwise improper.” None of the “marijuana memos” were on the list of twenty-five.

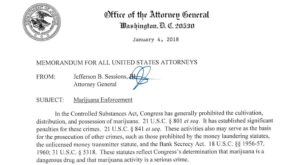

But on January 4, 2018, AG Sessions issued a memo, tersely titled “Marijuana Enforcement” which, among other things, rescinded five marijuana-related memos:

- Ogden Memo – October 19, 2009: David W. Ogden, Deputy Attorney General, “Memorandum for Selected United States Attorneys: Investigations and Prosecutions in States Authorizing the Medical Use of Marijuana”. This was issued at a time when only a handful of states were embarking on early medical marijuana programs.

- Cole I – June 29, 2011: James M. Cole, Deputy Attorney General, “Memorandum for United States Attorneys: Guidance Regarding the Ogden Memo in Jurisdictions Seeking to Authorize Marijuana for Medical Use”

- Cole II – August 29, 2013: “Memorandum for All United States Attorneys: Guidance Regarding Marijuana Enforcement”. Note that Cole II set out the eight enforcement priorities that were picked up in FinCEN’s February 14, 2014 Guidance (see below), but it said nothing about financial institutions, financial crimes, or the Bank Secrecy Act.

- Cole III – February 14, 2014: “Memorandum for All United States Attorneys: Guidance Regarding Marijuana Related Financial Crimes”. The title of this memo is important: unlike Cole I, Cole II brought in marijuana related financial crimes, the obligations of financial institutions, and the specter of those institutions violating federal law by knowingly providing services to marijuana-related businesses. In fact, Cole II noted that the Cole I guidance “did not specifically address what, if any, impact it would have on certain financial crimes for which marijuana-related conduct is a predicate.” Cole II addressed those impacts.

- Wilkinson Memo – October 28, 2014: Monty Wilkinson, Director of the Executive Office for U.S. Attorneys, “Policy Statement Regarding Marijuana Issues in Indian Country”.

Cole III needs to be read with the FinCEN Guidance issued the same (Valentine’s) day. I won’t repeat the FinCEN Guidance here (you can find it here https://www.fincen.gov/resources/statutes-regulations/guidance/bsa-expectations-regarding-marijuana-related-businesses) but its authors intended that it “clarifies how financial institutions can provide services to marijuana-related businesses consistent with their BSA obligations.” [Note that most financial institutions have interpreted that to mean they cannot provide services to marijuana-related businesses and meet their BSA obligations]. The FinCEN Guidance heavily relied on and quoted the Cole II eight priorities, and set out requirements for risk assessments, customer due diligence (seven distinct requirements), a requirement that “financial institutions should consider whether a marijuana-related business implicates a Cole priority or violates state law, twenty-five “red flags” for monitoring and surveillance of marijuana-related businesses, and how to (and shall) file Suspicious Activity Reports on every marijuana-related business customer, regardless of whether their activity is suspicious or not. Again, the vast majority of financial institutions have chosen not to knowingly bank marijuana-related businesses.[1]

But back to Attorney General Sessions and his “rescission of the Cole memo”. The terse title of his memo sends a clear message: “Marijuana Enforcement”. It was not titled “Managing Competing State and Federal Obligations In A Way That Advances The Positives Aspects of Marijuana Reform While Addressing Possible Negative Societal and Economic Harm”. Attorney General Sessions’ intent was clear from the outset: it was about enforcement.

And he directed that enforcement at banks, credit unions, and money remitters, among others. His memo began with a statement about the “significant penalties” for the “serious crimes” of cultivating, distributing, and possessing the “dangerous drug” marijuana in violation of the Controlled Substances Act. He then stated that these activities “also may serve as the basis for the prosecution of other crimes”, and he listed three such crimes: (1) those prohibited by the money laundering statutes under Title 18, sections 1956 and 1957; (2) the unlicensed money transmitter statute under Title 18, section 1960; and (3) the Bank Secrecy Act under Title 31, section 5318.

For banks, section 5318 of Title 31 is the “program” requirement: section 5318(h) provides that “in order to guard against money laundering through financial institutions, each financial institution shall establish anti-money laundering programs …”. Failure to have an effective program or being found to have a program that doesn’t contain all the necessary “pillars” or attributes required, can result in billion-dollar fines and penalties. Knowingly providing banking services to marijuana-related businesses can expose banks to program violations.

The result? Federal banking regulators need to provide more current, clearer guidance for banks and credit unions. Only the National Credit Union Association has responded to FinCEN’s February 2014 Guidance (by way of a July 18, 2014 letter from the NCUA’s Director of Examinations that his office had provided the FinCEN Guidance to NCUA field examiners “who are responsible for determining the compliance of financial institutions that provide services to marijuana-related businesses”). This need was recognized by the Treasury Department’s Office of Inspector General in an October 16, 2017 memo he wrote to Treasury Secretary Mnuchin. In one of the four challenges facing the Treasury Department – anti-money laundering, terrorist financing, and Bank Secrecy Act enforcement – the Inspector General wrote that “FinCEN is also challenged with providing clarifying guidance to financial institutions that are reluctant to do business with State-legalized marijuana dispensaries.”

That challenge must be taken up by FinCEN and the banking regulators. Unless and until the financial services industry gets clear, unequivocal, consistent, written laws, regulations, and guidance from Congress, Treasury, and Justice to provide banking services to marijuana-related businesses, it will and should do what it is currently doing – balancing the undue risks against the insufficient rewards – and continue to stand on the sidelines while our communities, veterans, patients, doctors, caregivers, and others suffer. Congressional and Executive Branch compassion[2]without the necessary collaboration and courage to act will not resolve this crisis.

[1] FinCEN data suggests that ~400 of the ~12,000, or about 3% of, US credit unions and banks are knowingly providing financial services to marijuana-related businesses.

[2] I’m not sure we’ll see much compassion for marijuana adoption from AG Sessions. In a speech he gave in March 2017 (https://www.justice.gov/opa/speech/attorney-general-jeff-sessions-delivers-remarks-efforts-combat-violent-crime-and-restore ) he stated: “ … we need to focus on the third way we can fight drug use: preventing people from ever taking drugs in the first place. I realize this may be an unfashionable belief in a time of growing tolerance of drug use. But too many lives are at stake to worry about being fashionable. I reject the idea that America will be a better place if marijuana is sold in every corner store. And I am astonished to hear people suggest that we can solve our heroin crisis by legalizing marijuana – so people can trade one life-wrecking dependency for another that’s only slightly less awful. Our nation needs to say clearly once again that using drugs will destroy your life.”