BigTech vs FinTech – Which Will Replace Traditional Banks?

Two recent papers have looked at the attributes, relative strengths and weaknesses, and likelihood to emerge as the main challenger to traditional financial institutions, of two different species of technology company: BigTechs and FinTechs. The two papers are:

- Financial Stability Board’s (FSB) February 2019 paper titled “FinTech and Market Structure in Financial Services”, available at https://www.fsb.org/wp-content/uploads/P140219.pdf

- Bank for International Settlements’ (BIS) April 2019 Working Paper titled “BigTech and the changing structure of financial intermediation”, available at https://www.bis.org/publ/work779.pdf

The BIS Working Paper makes a pretty compelling argument that the BigTech firms have some distinct advantages over FinTechs that make them more likely to usurp traditional financial institutions. Advantages such as an existing customer base (that is familiar with a user interface and messaging platform), and access to capital (often without the constraints that financial institutions have). And the BIS paper also sets out some of the advantages that BigTech has over traditional financial institutions, such as the financial sector’s current dependence on BigTech’s cloud-based computing and storage (think of Amazon’s AWS), technological advantages such as artificial intelligence, machine learning, and APIs, and regulatory advantages (BigTech isn’t burdened with Dodd-Frank, Basel capital restrictions, model risk regulations, and anti-money laundering program regulations).

But what are the differences between “BigTech” and “FinTech”? Both papers provide definitions for, and examples of, the two terms:

BigTech

- FSB: “refers to large technology companies that expand into the direct provision of financial services or of products very similar to financial products”

- BIS: “refers to large, existing companies whose primary activity is in the provision of digital services, rather than mainly in financial services … BigTech companies offer financial products only as one part of a much broader set of business lines.”

Both the FSB and BIS have the same BigTech firms: Facebook, Amazon, Apple, Google, Alibaba, Tencent, Vodafone, among others.

FinTech

- FSB: “technology-enabled innovation in financial services that could result in new business models, applications, processes or products with an associated material effect on the provision of ‘financial services’ … used to describe firms whose business model focuses on these innovations.”

- BIS: “refers to technology-enabled innovation in financial services with associated new business models, applications, processes, or products, all of which have a material effect on the provision of financial services.”

Both the FSB and BIS use QuickenLoans and SOFI, among others, as examples of FinTech firms.

BigTech is really … Big

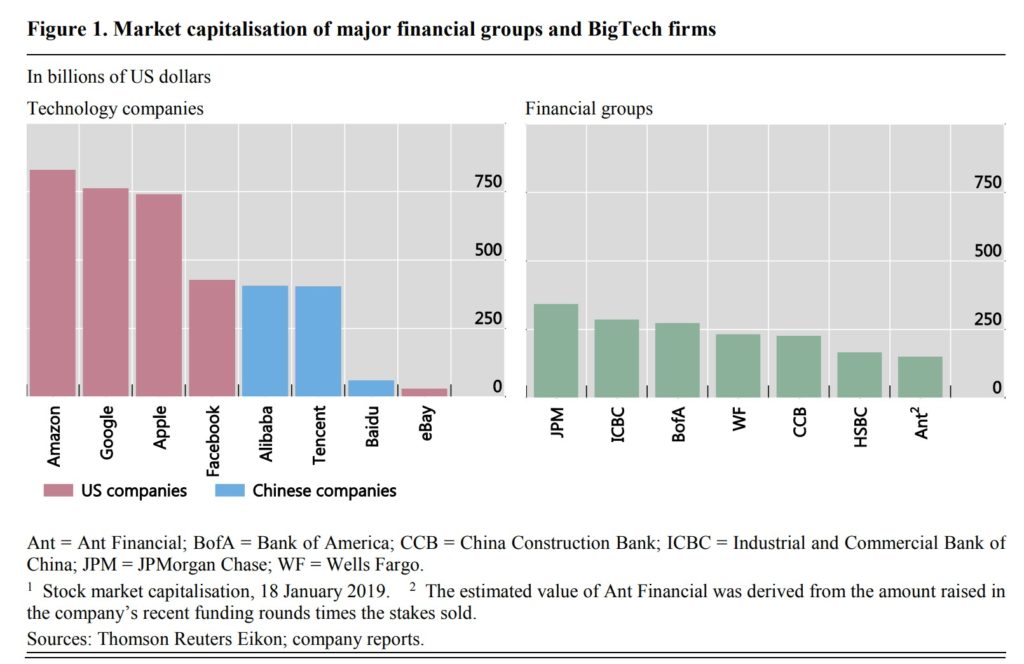

The BIS paper notes that the six largest global BigTech firms all have market capitalizations greater than the market capitalization of the largest global financial institution, JPMorgan Chase:

Which BigTech Firms are Providing What Financial Services Today?

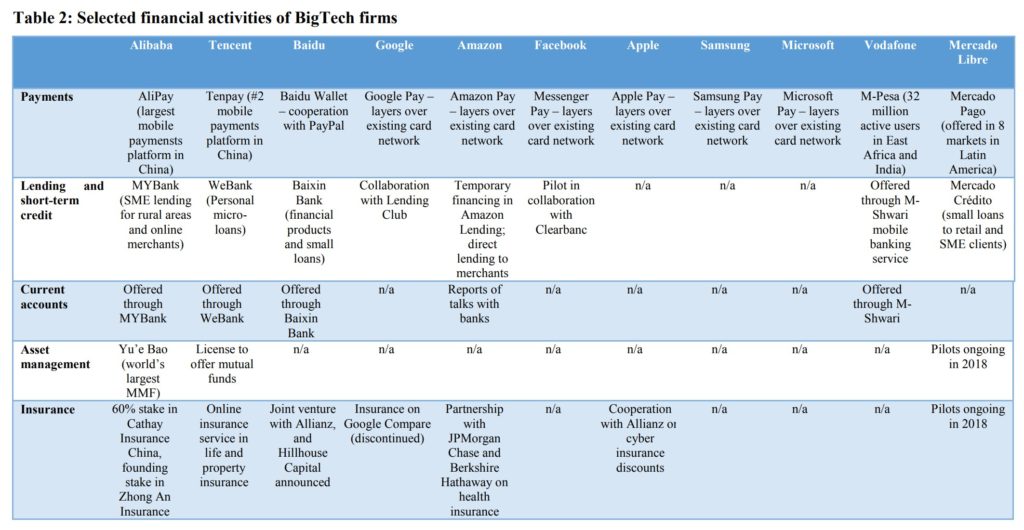

The BIS paper provides a great summary table of the five main types of financial services that the eleven dominant BigTechs are currently providing. It’s clear from this table that the three Chinese BigTechs – Alibaba, Tencent, and Baidu – have the most comprehensive suite of financial services/products, followed by the US trio of Google, Amazon, and Facebook.

Conclusion

There is no conclusion. Every day brings new entrants and participants, shifts, and changes. The regulatory environments are rapidly changing (although regulators and regulations always lag the regimes they regulate). But these two papers provide some insights into the world of FinTech, BigTech, and financial services, and are worth spending some time on.