On March 30, 2020 the Treasury Inspector General released a OIG Report titled “The Growth of the Marijuana Industry Warrants Increased Tax Compliance Efforts and Additional Guidance”. It is, in large part, a stinging rebuke of the way the IRS has handled – or has avoided handling – federal income tax payments made, and tax returns filed, by marijuana related businesses, or MRBs.

To the extent that Government laws and regulations discourage banking for marijuana businesses (and to the extent they encourage cash only transactions), they also may be indirectly and unintentionally encouraging tax noncompliance. – Report, page 5

From a federal tax perspective, MRBs face a number of hurdles.

Limited Access to Banking and the Impact on Paying Taxes

“Marijuana businesses have limited access to banking because marijuana is classified as a Schedule I controlled substance, and banks and credit unions who service marijuana businesses can potentially be charged with money laundering. Many financial institutions are not willing to risk potential civil or criminal liability associated with their obligations under the Bank Secrecy Act (BSA).” – Report, page 4.

And the entirety of page 5 of the Report is important:

“One of the main barriers for banks and credit unions is the information reporting requirements when providing banking services to marijuana businesses. For example, BSA regulations require the filing of a Suspicious Activity Report (SAR) when a financial institution knows, suspects, or has reason to suspect that a transaction of $5,000 or more involves funds derived from an illegal activity or is an attempt to disguise funds derived from an illegal activity.

The SAR filing requirement is both costly and risky as the reporting of all transactions the financial institution has with the respective marijuana business can be extensive, and if the activity is incorrectly reported, fines to the financial institution could result. Banks and credit unions that service marijuana businesses may charge large fees to compensate for the extensive reporting requirements and risk for providing services to these businesses. One credit union in California stated it was charging banking fees to marijuana businesses of up to $10,000 as an upfront fee and $5,000 a month for producers and $7,500 a month for dispensaries. Another small credit union in Oregon that serves marijuana businesses stated the credit union filed more than 13,500 individual reports over the past two years (2017 and 2018) for approximately 500 cannabis clients.

We have also identified recent trends with banks and credit unions providing banking services to marijuana businesses. According to the U.S. Treasury Financial Crimes Enforcement Network, the number of financial institutions actively banking marijuana-related businesses increased from 401 in October 2017 to 715 in June 2019. However, the lack of banking access continues to be an issue in the marijuana industry with most banks or credit unions across the United States not willing to accept marijuana business customers. Marijuana businesses without bank account access are also unable to set up merchant accounts for accepting credit or debit cards. This results in most marijuana businesses conducting business transactions in cash only. Marijuana businesses may have automated teller machines on the premises for customers to facilitate cash only transactions.

The main tax-related concern about cash intensive businesses is that cash transactions are more difficult to track and are therefore more likely to go unreported to the IRS. Unlike checks and credit card receipts, cash transactions do not generally result in third-party information capable of being reported to the IRS. To the extent that Government laws and regulations discourage banking for marijuana businesses (and to the extent they encourage cash only transactions), they also may be indirectly and unintentionally encouraging tax noncompliance.”

(citations omitted)

There are at least three issues stemming from the difficulties that cash intensive businesses, such as MRBs, have in obtaining and keeping banking relationships. First is that they may not file tax returns at all: the OIG observed a filing rate of active MRBs to be between 60% to 70%. Second, they may under report income that is not flowing through a bank relationship or is not otherwise being tracked and monitored: the OIG observed an under-reporting rate of about 25%. And third is the penalty that filers must pay for not paying federal taxes electronically. Known as the Failure To Deposit, or FTD penalties for not making tax payments by ACH, the OIG found that almost half the MRBs that were potentially unbanked, based on FTD data, paid penalties. The OIG recommended, at page 22 of the Report:

“Taxpayers including marijuana businesses should not be penalized because they cannot satisfy their respective employment tax obligations via the required electronic transmission process. The current conflict between Federal and State law regarding marijuana business activity is well established regarding banking access. The IRS needs to increase awareness of the current FTD penalty relief policies for unbanked taxpayers such as marijuana businesses.”

This was one of the few (of six) recommendations that the IRS agreed to.

I.R.C. §280E from 1982

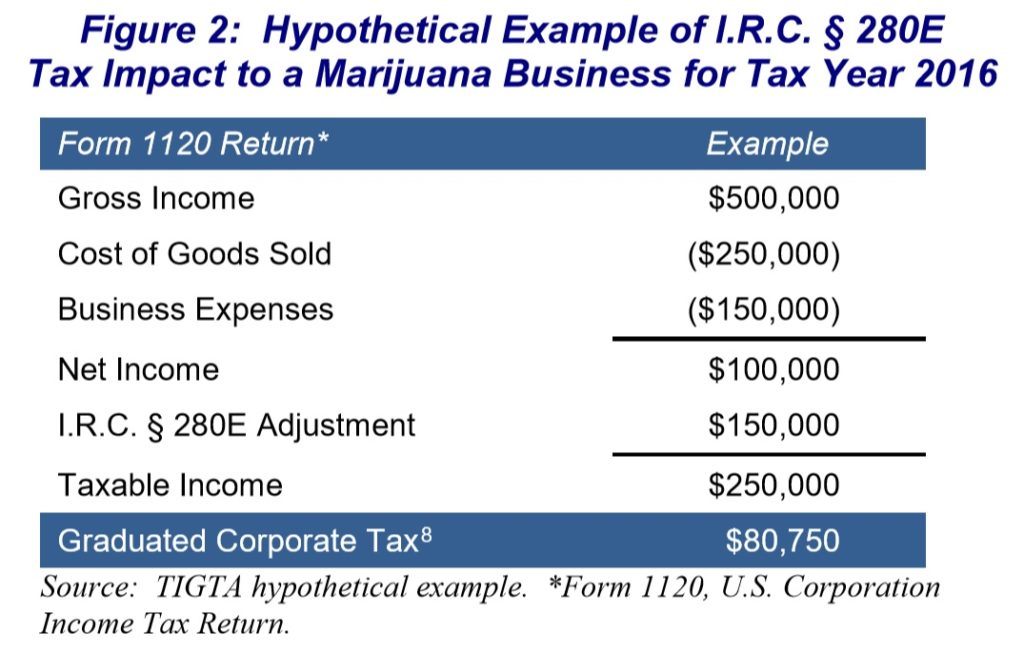

In 1982, section 280E was added to the Internal Revenue Code to prohibit businesses engaged in illegal activity from deducting business expenses such as payroll, employee benefits, and rent from gross income for purposes of determining federal income tax. Section 280E was the legislative response to a number of court decisions that allowed illegal businesses to deduct certain expenses incurred in operating those illegal businesses. Since the Controlled Substances Act makes it federally illegal to manufacture or distribute marijuana, §280E then prohibits the deduction of expenses incurred in trafficking controlled substances. The only expenses allowed by §280E is cost of goods sold, so businesses that sell marijuana can reduce gross receipts by the cost of goods sold but cannot deduct other business expenses.

The Report included a hypothetical example of the impact of §280E to a marijuana related business. As seen from Figure 2, the effective tax rate is about 80% – $80,750 on net income of $100,000.

The OIG found that about 60% of the MRBs in their sample that filed federal tax returns improperly applied §280E adjustments, yet “the IRS lacks guidance to taxpayers and tax professional in the marijuana industry” and that “no references to marijuana businesses can be found in IRS publications.” The OIG estimated the 5-year impact on federal tax collected in the three states (California, Oregon, and Washington) was almost $250 million.

I.R.C. §471(c) from 2017

The Tax Cuts and Jobs Act of 2017 added section 471(c) to the Internal Revenue Code to provide some relief to small businesses in whether and how they could track and account for their cost of goods sold. The OIG noted:

“Under this new provision, marijuana businesses could argue they are entitled to use a method of accounting that includes all expenses in cost of goods sold to potentially avoid the impact of I.R.C. § 280E. According to IRS Chief Counsel, at least two practitioners have identified this issue and have questioned IRS personnel on how the IRS plans to handle I.R.C. § 471(c) as applied to marijuana industry taxpayers. These practitioners have identified the potential unintended consequence of I.R.C. § 471(c) that appears to allow small marijuana businesses to include non-cost of goods sold expenses in their cost of goods sold and potentially avoid the application of I.R.C. § 280E. IRS Chief Counsel noted that practitioners assert that the new law may provide small business taxpayers wide latitude to characterize all expenditures as cost of goods sold. The effect of the law is still uncertain.” – Report, page 15.

The OIG’s fourth recommendation was that the IRS should publish guidance on the impact of § 471(c) on § 280E. The IRs response was, essentially, that it was too busy:

Recommendation: that the IRS “develop and distribute, internally and externally, specific guidance on the application of I.R.C. § 471(c) in conjunction with I.R.C. § 280E for taxpayers that report Schedule I related activities on Federal tax returns.”

IRS Response: “IRS Chief Counsel disagreed with this recommendation because the Department of the Treasury and Chief Counsel resources at present are focused on priority guidance in response to the Tax Cuts and Jobs Act and identifying and reducing regulatory burdens in response to Executive Order 13789.” – Report, page 22.

Marijuana Businesses – “High Impact” for IRS Attention

The IRS has acknowledged that the marijuana industry is a “high impact compliance area” because of its unique tax compliance risks due to I.R.C. § 280E, cash intensive sales, and potential lost tax revenue. In fact, the OIG report estimated a five-year impact of approximately $475 million. The OIG had two recommendations for the IRS: that the IRS develop a comprehensive compliance approach for the marijuana industry (recommendation 1 on page 13); and that the IRS use more state information (which it was reluctant to use) to identify non-filers (recommendation 5 at page 20). The IRS response to both recommendations was the same:

Recommendation 1 – IRS should develop a comprehensive compliance approach for the marijuana industry and leverage state marijuana business lists to identify non-compliant taxpayers. IRS Response: “whether it pursues taxpayers in the marijuana industry depends on priorities and available resources … it will use data analytics to identify the size and scope of non-compliant taxpayers and prioritize the compliance activities based on resources available.” – Report, page 13

Recommendation 5 – IRS should leverage publicly available state tax information and expand use of Fed/State agreements to identify non-filers and unreported income in the marijuana industry. IRS Response: “whether it pursues taxpayers in the marijuana industry depends on priorities and available resources … it will review the publicly available State tax information and Fed/State agreements to determine whether and how they could be legally, systemically, effectively, and efficiently used in compliance activities.” – Report, page 20

Conclusion

It’s unfortunate that this report was published in the midst of the Great Pandemic of 2020: but for the pandemic, it would have garnered more attention from the public and Congress. Tax compliance should be encouraged and tax enforcement should be consistently and fairly applied. The Treasury Inspector General has reported that neither is happening with respect to the marijuana industry, and the IRS response to its Inspector General seems to be “we’ll think about, but we’ve got other things to worry about”. The IRS doesn’t seem too interested in an industry made up of thousands of marijuana related businesses employing hundreds of thousands of people that is apparently under-reporting hundreds of millions of dollars – perhaps billions of dollars – of federal taxes. After the coronavirus pandemic eases, perhaps somebody in Congress can ask the Commissioner of the IRS what would get his attention.