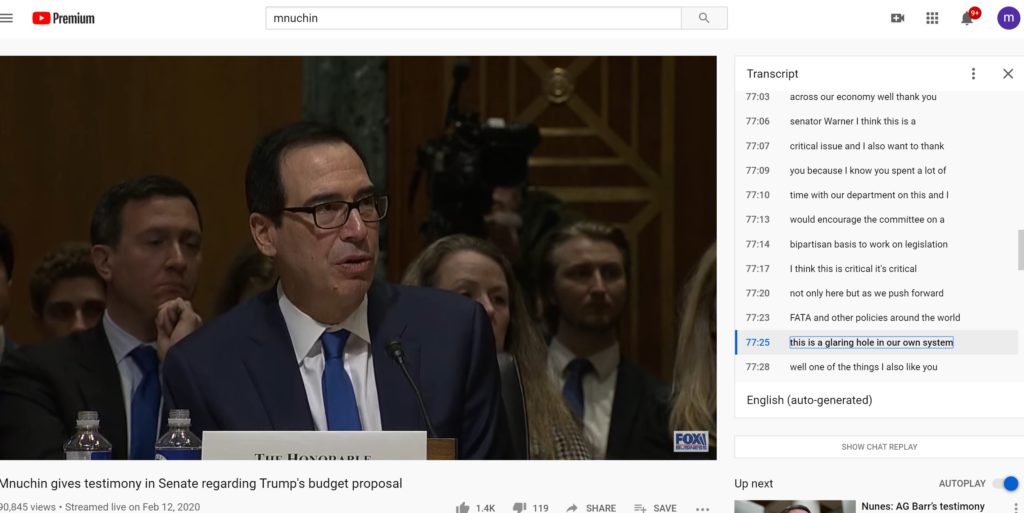

On February 12, 2020, Treasury Secretary Mnuchin testified before the Senate Finance Committee on the President’s Fiscal Year 2021 budget. At the 75:22 mark of the hearing, Senator Mark Warner (D. VA) began a series of statements and questions about the lack of beneficial ownership information. Senator Warner observed that the just-submitted (February 6th) 2020 National Strategy for Combating Terrorist and Other Illicit Financing – National Strategy – indicated that the number one vulnerability facing the U.S. efforts to combat terrorism, money laundering, and proliferation financing was the lack of beneficial ownership requirements at the time of company formation.

Senator Warren noted that “one of the key vulnerabilities identified in the report is the lack of a legally binding requirement to collect beneficial ownership at the time of company formation.” At the 76:50 mark, the Senator posed the following question:

Mr. Secretary, do you agree that one of our most urgent national security and regulatory problems is that the US Government still has no idea who really controls shell companies?

At the 77:25 mark Secretary Mnuchin replied:

“This is a glaring hole in our own system.”

What did the National Strategy have to say about lack of beneficial ownership information?

2020 National Strategy for Combating Terrorist and Other Illicit Financing – Key Vulnerability is Lack of Beneficial Ownership Information

The National Strategy listed 10 vulnerabilities. In the “Vulnerabilities Overview” section (page 12), the first of the “most significant vulnerabilities in the United States exploited by illicit actors” was “the lack of a requirement to collect beneficial ownership information at the time of company formation and after changes in ownership.” The Strategy goes on:

“Misuse of legal entities to hide a criminal beneficial owner or illegal source of funds continues to be a common, if not the dominant, feature of illicit finance schemes, especially those involving money laundering, predicate offences, tax evasion, and proliferation financing.

*****

More than two million corporations and limited liability companies (LLCs) are formed in the United States every year. Domestic shell companies continue to present criminals with the opportunity to conceal assets and activities through the establishment of a seemingly legitimate U.S. businesses. The administrative ease and low-cost of company formation in the United States provide important advantages and should be preserved for legitimate investors and businesses. However, the current lack of disclosure requirements gives both U.S. and foreign criminals a method of obfuscation that they can and have repeatedly used, here and abroad, to carry out financial crimes. There are numerous challenges for federal law enforcement when the true beneficiaries of illicit proceeds are concealed through shell or front companies. Money launderers and others involved in commercial activity intentionally conduct transactions through corporate structures in order to evade detection, and may layer such structures, much like Matryoshka dolls, across various secretive jurisdictions. In many instances, each time an investigator obtains ownership records for a domestic or foreign entity, the newly identified entity is yet another corporate entity, necessitating a repeat of the same process. While some federal law enforcement agencies may have the resources required to undertake complex (and costly) investigations, the same is often not true for state, local, and tribal law enforcement.

*****

To address a major aspect of this recognized vulnerability, FinCEN issued a Customer Due Diligence (CDD) Rule, which became fully enforceable for covered financial institutions on May 11, 2018. This rule requires, among other things, more than 23,000 covered financial institutions to identify and verify the identities of beneficial owners of legal entity customers at the time of account opening and defined points thereafter.

*****

While the CDD Rule addressed the gap of collecting beneficial ownership information at the time of account opening, there remains no categorical obligation at either the state or federal level that requires the disclosure of beneficial ownership information at the time of company formation. Treasury currently does not have the authority to require the disclosure of beneficial ownership information at the time of company formation without legislative action. The CDD

Rule is an important risk-mitigating measure for financial institutions and an equally important resource for law enforcement, but it is not a comprehensive solution to the problem and a crucial gap remains.

The United Sates is traditionally the global leader on AML/CFT. But the lack of a legally-binding requirement to collect beneficial ownership information at the time of company formation hinders the ability of all regulated sectors to mitigate risks and law enforcement’s ability to swiftly investigate those entities created to hide ownership. Crucially, this deficiency drives significant costs and delays for both the public and private sectors. The 2016 Financial Action Task Force (FATF) Mutual Evaluation Report (MER) underscored the seriousness of this deficiency. Indeed, this gap is one of the principal reasons for the United States’ failing grade regarding the efficacy of its mechanisms for beneficial ownership transparency.” (citations omitted)

Key Priorities of the US Government in Combating Terrorism, Money Laundering, and Proliferation Financing

After setting out the threats and vulnerabilities, the 2020 National Strategy turned to the US Government’s three key priorities in fighting terrorist and other illicit financial activity:

“To make this 21st century AML/CFT regime a practical reality, the U.S. government will continue to review and pursue the following key priorities: (1) modernize our legal framework to increase transparency and close regulatory gaps; (2) continue to improve the efficiency and effectiveness of our regulatory framework for financial institutions; and (3) enhance our current AML/CFT operational framework. This will include the supporting actions discussed below.” (page 39)

Priority 1: Increase Transparency and Close Legal Framework Gaps

This first priority has four supporting actions: (i) require collection of beneficial ownership information by the government at time of company formation and after ownership changes; (ii) minimize the risks of the laundering of illicit proceeds through real estate purchases; (iii) extend AML program obligations to certain financial institutions and intermediaries currently outside the scope of the BSA; and (iv) clarify or update our regulatory framework to expand coverage of digital assets.

Supporting Action: Require the Collection of Beneficial Ownership Information by the Government at Time of Company Formation and After Ownership Changes

Currently, there is no categorical obligation at the state or federal level that requires the disclosure of beneficial ownership information at the time of company formation. Also, Treasury does not have the authority to require the disclosure of beneficial ownership information at the time of company formation without legislative action. Having immediate access to accurate information about the natural person behind a company or legal entity is essential for law enforcement and other authorities to disrupt complex money laundering and proliferation financing networks. However, this must be balanced with individual privacy concerns and not be unduly burdensome for small businesses.

The Administration believes that congressional proposals to require the collection of beneficial ownership information of legal entities by FinCEN, including the Corporate Transparency Act represents important progress in strengthening national security, supporting law enforcement, and clarifying regulatory requirements. The Administration is working with Congress. The aim—pass beneficial ownership legislation in 2020. It is important that any law enacted should closely align the definition of “beneficial owner” to that in FinCEN’s CDD Rule, protect small businesses from unduly burdensome disclosure requirements, and provide for adequate access controls with respect to the information gathered under this bill’s new disclosure regime.

The ILLICIT CASH Act – A Solution to the Beneficial Ownership Vulnerability

The 2020 National Strategy refers to congressional proposals. One of those was mentioned by Senator Warren, who referred to the bipartisan support that exists in Congress for addressing this vulnerability through a Senate bill, the ILLICIT CASH Act, S.2563 before the Senate Banking Committee. Senator Warren noted that the ILLICIT CASH Act, or Improving Laundering Laws & Increasing Comprehensive Information Tracking of Criminal Activity in Shell Holdings Act (clearly one of the great “backronyms” of all time!) had the support of 4 Democrats and 4 Republicans. Title IV of that bill set out “Beneficial Ownership Disclosure Requirements”, and included provisions to establish beneficial ownership reporting requirements. Although there is bipartisan and Administration support for the bill, not everyone is as supportive: the American Bar Association, for one, opposes the bill.

The American Bar Association – Supportive of Reasonable Measures to Combat Money Laundering, But Not the ILLICIT CASH Act

The American Bar Association – ABA Position on Combating Financial Crime – “supports reasonable and necessary domestic and international measures designed to combat money laundering and terrorist financing. However, the Association opposes legislation and regulations that would impose burdensome and intrusive gatekeeper requirements on small businesses or their attorneys or undermine the attorney-client privilege, the confidential attorney-client relationship, or the right to effective counsel.” With respect to the ILLICIT CASH Act, the ABA opposes key provisions, and expressed that opposition in a June 19, 2019 letter to the Chairman and Ranking Member of the Senate Banking Committee. ABA Letter Opposing the ILLICIT CASH Act. And on their webpage:

“The ILLICIT CASH Act would require anyone involved in a real estate purchase or sale to file a detailed report with the Treasury Department containing the name of the natural person purchasing the real estate, the amount and source of the funds received, the date and nature of the transaction, and other data. Because attorneys often represent clients in real estate transactions, the ILLICIT CASH Act would compel many attorneys to disclose confidential client information to the government, a result plainly inconsistent with state court ethics rules.”

Conclusion – Courage to Compromise Is Needed if We Are to Make Inroads in the Fight Against Terrorism, Money Laundering, and Proliferation Financing

The ABA’s concerns about burdensome and intrusive requirements and undermining the attorney-client privilege are understandable. The Treasury Department’s concerns about the vulnerabilities of, and need to amend, the broken beneficial ownership regime are understandable. Democrats and Republicans in the House and Senate, and Republicans in the White House, will need to come together to draft, pass, and enact laws to fix the broken beneficial ownership regime. All of these groups, and more, will need the courage to compromise if we are to fill the most glaring hole in our AML system.