Wouldn’t it be great if Treasury published a report, perhaps semi-annually, that contained a detailed analysis identifying patterns of suspicious activity and other investigative insights derived from suspicious activity reports (SARs) and investigations conducted by federal, state, and local law enforcement agencies (to the extent appropriate) and distributed that report to financial institutions that filed those SARs?

To get Treasury to do that, though, would probably require Congress to pass a law compelling it to do so.

Hold it. Congress did pass that law. Almost 18 years ago. And, by all accounts, it’s still on the books. What happened to those semi-annual reports? When did they begin? If they began, when did they end?

Section 314(d) – Its Origins

What became 314(d) was introduced in the House version of what became the USA PATRIOT Act. The House version, the Financial Anti-Terrorism Act, was introduced on October 3, 2001. It was marked up by the House Financial Services Committee on October 11. The Senate version, originally titled the Uniting and Strengthening America Act, or USA Act, was introduced on October 4th and had sections 314(a) (public to private sector information sharing), 314(b) (cooperation among financial institutions, or private-to-private sector information sharing), and 314(c) (“rule of construction”). There was no 314(d) in that early version.

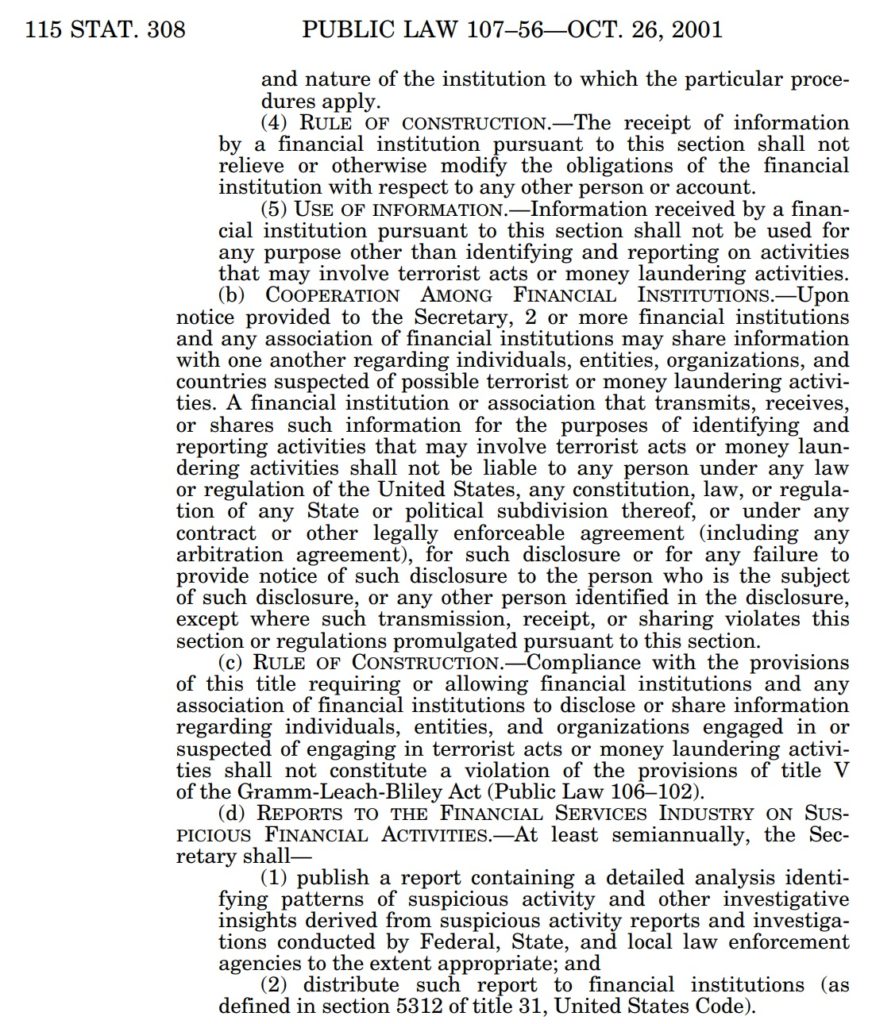

On October 17th, HR 3004, the Financial Anti-Terrorism Act, was passed by the House 412-1. Title II was “public-private cooperation”. Section 203 was:

“Reports to the Financial Services Industry on Suspicious Financial Activities – at least once each calendar quarter, the Secretary shall (1) publish a report containing a detailed analysis identifying patterns of suspicious activity and other investigative insights derived from suspicious activity reports and investigations conducted by federal, state, and local law enforcement agencies to the extent appropriate; and (2) distribute such report to financial institutions as defined in section 5312 of title 31, US code.”

The Senate and House versions were reconciled, and on October 23rd the House Congressional Record shows a consideration of what was then the USA PATRIOT Act. That version of the bill then included what had been section 203 and was now 314(d). It was the same, except instead of a quarterly report it was a semi-annual report (“at least once each calendar quarter” was changed to “at least semiannually”).

SAR Activity Review – Was That The Answer to 314(d)?

The ABA has written, and at least one former FinCEN employee has stated that the “SAR Activity Review – Trends, Tips, and Issues” was the response to 314(d). The SAR Activity Reviews were excellent resources. They contained sections on SAR statistics, national trends and analysis, law enforcement cases, tips on SAR form preparation and filing, issues and guidance, and an industry forum. The first SAR Activity Review noted that it was published under the auspices of the BSAAG, was to be published semi-annually in October and April, and was “the product of a continuing collaboration among the nation’s financial institutions, federal law enforcement, and regulatory agencies to provide meaningful information about the preparation, use, and utility of SARs.” Although that certainly sounds like it is responsive to section 314(d), there is no reference to 314(d).

And the first SAR Activity Review was published more than a year before 314(d) was passed. Even the first SAR Activity Review published after the enactment of the USA PATRIOT Act and section 314(d) – the 4th issue published on July 31, 2002 – didn’t make any reference to 314(d). Beginning with the 6th issue of the SAR Activity Review, published in October 2003, the authors broke out the statistics from the “Trends, Tips & Issues” document and published a separate, and more detailed, “SAR Activity Review – By The Numbers”. The last SAR Activity Review (the 23rd) and the last “By The Numbers” (the 18th) were published on April 30, 2013. None of those forty-one publications referenced 314(d). After the SAR Activity Reviews stopped, FinCEN continued to publish “SAR Statistics”, and did so three times from June 2014 through March 2017. For the last few years, FinCEN has maintained SAR Stats on its website – https://www.fincen.gov/reports/sar-stats – that is updated on a monthly basis. Those statistics are useful, but cannot be thought of as “containing a detailed analysis identifying patterns of suspicious activity and other investigative insights derived from suspicious activity reports and investigations conducted by federal, state, and local law enforcement agencies to the extent appropriate”, quoting the 314(d) language.

Does Anyone Know What Happened to 314(d)?

I don’t have the answer to that question. Perhaps 314(d) is seen as satisfied by the accumulation of advisories, guidance, bulletins, etc., published by FinCEN and other Treasury bureaus and agencies and departments from time to time. Perhaps there is a Treasury Memorandum out there that I’m not aware of that provides a simple explanation. Perhaps not: most BSA/AML experts I speak with are not even aware of 314(d), and if the SAR Activity Review did satisfy the spirit and intent of 314(d), the last one was published more than six years ago. But everyone in the private sector BSA/AML risk management space has been clamoring for more feedback from law enforcement and FinCEN on the effectiveness and usefulness of their SAR filings. Perhaps a renewed (or any) focus on 314(d) is the answer. The revival of 314(d) could give FinCEN the mandate they’ve been looking for to provide more valuable information to the private sector producers of Suspicious Activity Reports. We would all benefit.