Like most industries, the financial crimes risk management industry is rank with jargon, axioms, and hackneyed phrases we all toss around with plenty of abandon but little discipline. Rising to the top of this heap is “Subject Matter Expert” or “SME”.

Like most industries, the financial crimes risk management industry is rank with jargon, axioms, and hackneyed phrases we all toss around with plenty of abandon but little discipline. Rising to the top of this heap is “Subject Matter Expert” or “SME”.

More important to the success or failure of any endeavor than the self-styled Subject Matter Expert is the dreaded Subject Matter Enthusiast. The Expert is just that: someone with talent, training, subject matter knowledge, environmental knowledge, and years of experience (and not just one year of experience many times, but many years of experience). The true Expert doesn’t see him or herself as an expert, won’t call himself (I’m going single pronoun from here on, if that’s OK) an expert, probably doesn’t see himself as an expert, but he possesses those traits, or enough of them, to truly be, and be seen as, a Subject Matter Expert. The Enthusiast, on the other hand, often calls himself an Expert when he isn’t, or thinks of himself as possessing enough of as many of the traits needed to pass himself off as an Expert. The Enthusiast overcomes his lack of true expertise with just enough confidence, hubris, and (frankly) enthusiasm to move a project ahead or design a monitoring system just long enough to allow auditors, regulators, and prosecutors to catch up … and for the experts to bail him (and the project or monitoring system) out.

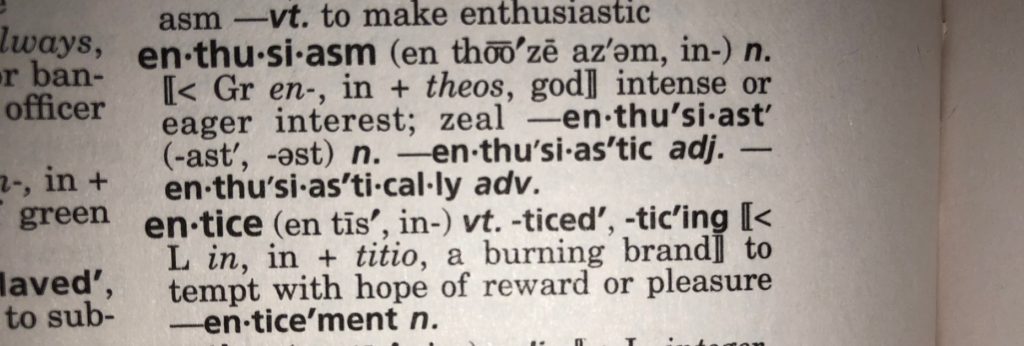

A Subject Matter Enthusiast usually means well but isn’t the “expert” he thinks he is. Unwittingly, he can cause all sorts of damage (note that the word immediately after “enthusiasm” is “entice” … indeed, Enthusiasts often entice people into doing things they wouldn’t otherwise do). And as a rule, a business person in a typical financial institution is a Subject Matter Expert in their business and a Subject Matter Enthusiast in your business (financial crimes risk management), and risk management professionals are Subject Matter Experts in risk and Subject Matter Enthusiasts about the businesses. The trick is to be respectful of and acknowledge where each other’s expertise begins and ends, and enthusiasm begins and ends, and somehow meet in the middle.

A Subject Matter Enthusiast usually means well but isn’t the “expert” he thinks he is. Unwittingly, he can cause all sorts of damage (note that the word immediately after “enthusiasm” is “entice” … indeed, Enthusiasts often entice people into doing things they wouldn’t otherwise do). And as a rule, a business person in a typical financial institution is a Subject Matter Expert in their business and a Subject Matter Enthusiast in your business (financial crimes risk management), and risk management professionals are Subject Matter Experts in risk and Subject Matter Enthusiasts about the businesses. The trick is to be respectful of and acknowledge where each other’s expertise begins and ends, and enthusiasm begins and ends, and somehow meet in the middle.

Oddly enough, most of us in the financial crimes risk management industry are a little bit of both: we may be an Expert in technology and an Enthusiast in AML, or an Expert in auditing and an Enthusiast in AML, or an Expert in AML and an Enthusiast in technology … the key is to recognize where (whether) your Expertise begins and ends, and where your Enthusiasm begins and ends, and to know where your colleagues fall on the Expertise/Enthusiasm spectrum. And the most successful financial crimes risk management efforts are those where everyone involved in the effort knows where his and everyone else’s expertise and enthusiasm begin and end, and where everyone is respectful of and accepts others’ expertise.

This seems particularly important in this new age of disruptive fintech. I’ve seen some great fintech companies that are technology experts but financial crimes enthusiasts but aren’t aware (or aware enough) of their lack of financial crimes expertise and are not respectful enough of the financial crimes expertise of those they’re trying to sell to.

So, the next time you’re pulling together a team to solve any financial crimes problem – and that team can include fintech companies looking to sell you a “solution” – make sure everyone on the team recognizes and is aware of every team member’s Expertise/Enthusiasm spectrum. Knowing, and admitting, where/whether your expertise begins and ends, and your enthusiasm begins and ends, will make your team, and project, a success.

(Thomas Friedman had a different twist on subject matter enthusiasts in a NYT Op/Ed from April 24, 2001, where he wrote: “The well-intentioned but ill-informed being led by the ill-intentioned but well-informed.”)