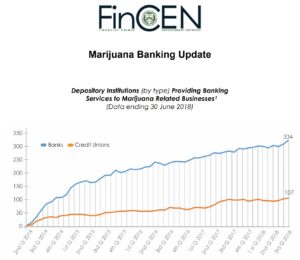

The U.S. financial industry is in its 5th year of filing “marijuana” Suspicious Activity Reports (SARs) pursuant to guidance issued by FinCEN on February 14, 2014. As FinCEN reports this week, 334 banks and 107 credit unions (out of approximately 11,000) are “providing banking services to marijuana-related businesses” or “actively providing banking services to marijuana-related businesses” or “actively banking marijuana-related businesses” (quoting from the title of chart 1 of the update, the text accompanying chart 1, and chart 2, respectively). But I believe FinCEN’s descriptions are not accurate, as many financial institutions are not, in fact, knowingly providing banking services to marijuana-related businesses (MRBs). Instead, they consider these to be prohibited businesses that they do not knowingly bank, and if they uncover any MRBs through due diligence, monitoring, or surveillance, file a “Marijuana Termination” SAR and exit the relationship.

There is some good data in this report, but not much usable information. For example, there is nothing on the size and locations of the banks and credit unions filing the marijuana SARs, which states are involved, whether the activity involves medicinal/medical or recreational/adult-use MRBs, or how many MRBs are being reported and why. Next quarter, I’d like to see FinCEN report provide some of this information. In addition, FinCEN should consider “cleaning up” the report. I offer three suggestions.

First, when describing the three marijuana SAR categories (Limited, Priority, and Termination), FinCEN refers to Cole Memo “red flags” … but none of the three Cole Memos (or the Ogden Memo) have any “red flags”. Rather, the Cole Memos instruct federal prosecutors to “focus enforcement resources on persons or organizations whose conduct interferes with any one or more of the [eight] important priorities”. The red flags are actually set out in the FinCEN guidance – and there are 23 red flags to consider – and that original guidance correctly refers to the Cole Memo “priorities” when describing the three marijuana SAR types. Although some may quibble with my distinction, the term “red flags” is a red flag for banking auditors and regulators … the Cole Memo has priorities, the FinCEN guidance has red flags.

Second, footnote 1 of this recent Report describes when to use each of the three marijuana SAR types. For the marijuana “Termination” SAR, FinCEN indicates that it is to be used when the financial institution has decided to terminate its relationship with the MRB because (1) the financial institution “has decided not to have marijuana related customers for business reasons” or (2) the MRB is not fully compliant with the appropriate state’s marijuana regulations, or (3) the MRB raises one or more of the Cole Memo red flags. (Note the use of the alternative “or”). This language is different than the 2014 guidance, which has nothing about deciding not to have marijuana related customers for business reasons. I would like to see FinCEN provide the industry with guidance for not only exiting MRBs, but also about simply not providing banking services to marijuana related customers for business/risk reasons. It is clearly needed if only 440 of more than 11,000 banks and credit unions are knowingly or unknowingly providing banking services to MRBs.

Third, there is nothing in the 2014 guidance, nor in this report, that defines a “marijuana related business”. It is certainly implied that to be an MRB requires being subject to state marijuana regulations, but clear guidance would be helpful. Also, there are many businesses that do not have to be licensed and are not governed by state marijuana regulations, but are indirectly dealing with MRBs. Footnote 7 of the 2014 guidance referred to indirect services (“a financial institution could be providing services to a non-financial customer that provides goods or services to a marijuana-related business (e.g., a commercial landlord that leases property to a marijuana-related business). In such circumstances where services are being provided indirectly, the financial institution may file SARs based on existing regulations and guidance without distinguishing between “Marijuana Limited” and “Marijuana Priority.”): but it did not differentiate between (what I’ll call) Direct MRBs (those that are required to be licensed under state marijuana regulations) and Indirect MRBs (those that capital, services, products, property to Direct MRBs). The Small Business Administration has addressed these “indirect” MRBs – see the News from May 2, 2018, below. It would be great if FinCEN did, also.

Finally, this Report describes the marijuana Limited-Priority-Termination SAR categories as “three phases for describing a financial institution’s relationship to marijuana-related businesses.” That isn’t accurate: there is not a progression or phasing of these categories, and the original 2014 guidance didn’t describe them that way. A bank or credit union doesn’t have to start with a Limited SAR, then progress to a Priority SAR, then end with a Termination SAR: they are three distinct SARs, dependent on the circumstances of each case.