I’ve written two articles on the CARES Act’s Paycheck Protection Program (PPP) – the $350 billion, or $350,000,000,000, pot of federal money available for the lucky few hundred thousand or so of the roughly thirty million American small businesses that can navigate the labyrinth of regulatory requirements to apply for and be approved to get a loan that is intended to cover their payroll for 8 weeks or so. See The CARES Act and the PPP – We Know A Surge of Fraud is Coming

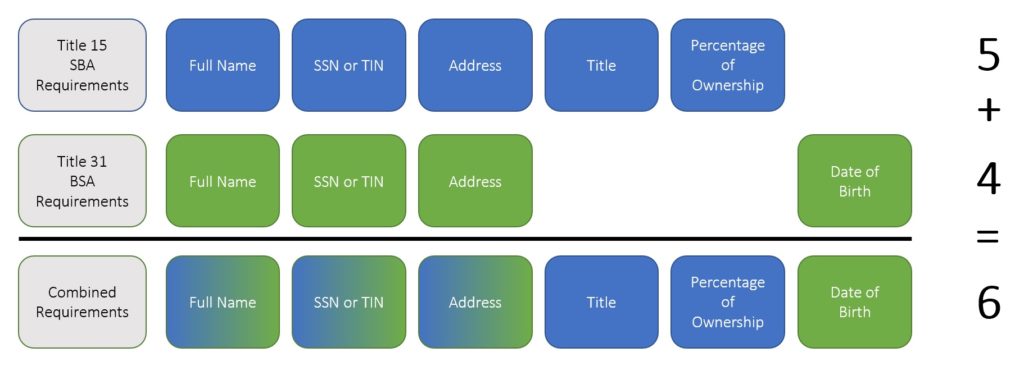

On April 13th the Treasury Department issued some guidance intended to clarify how the PPP lenders – mostly banks and credit unions – can satisfy some of their regulatory requirements around identifying the beneficial owners of the small businesses they’ll be lending to. In some of the more creative math I’ve seen in a while, they were somehow able to take the 5 things required under one set of regulations, combine them with the 4 things required under another set of regulations, and come up with 6 things. Instead of speeding up the delivery of the much-needed assistance to small businesses across America, their math may have the opposite effect.

Title 15 Small Business Administration (SBA) requirements

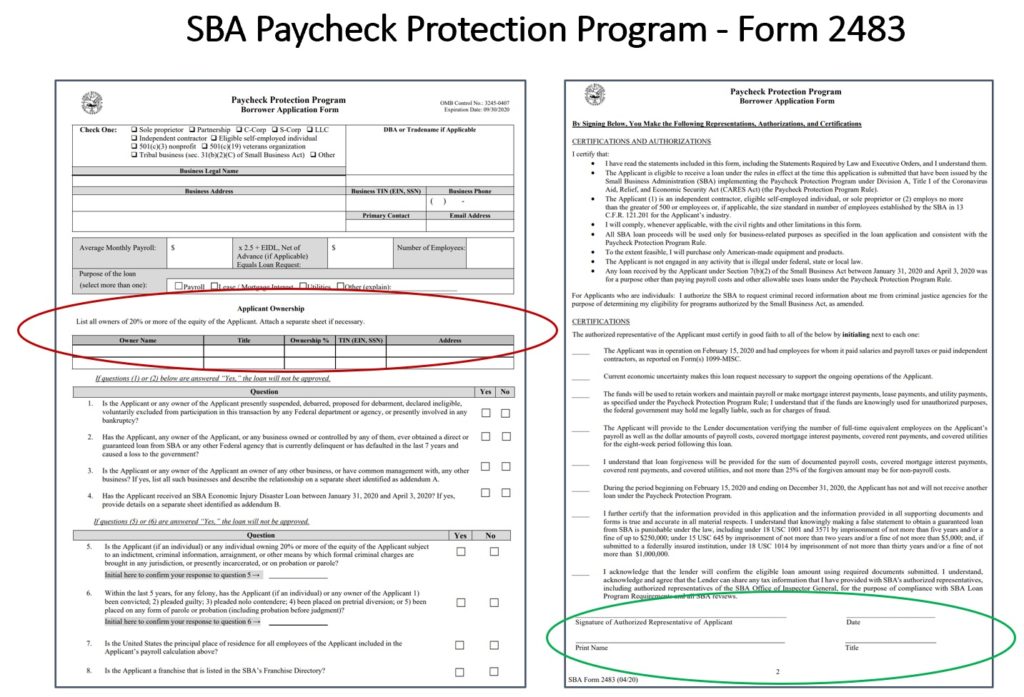

On April 2nd the SBA rolled out its requirements. Among other things, the two-page Borrower Form requires the “authorized representative” of the small business to certify a number of things, notably (for purposes of this labyrinth) five pieces of information – name, SSN/TIN, Address, Title, and Ownership Percentage – of up to five people that own 20 percent or more of the small business. And, according to the Interim Final Rule published on April 2nd, the lender (bank or credit union) can rely on that certification. And the authorized representative has to provide their name, title, and a signature.

On April 2nd the SBA rolled out its requirements. Among other things, the two-page Borrower Form requires the “authorized representative” of the small business to certify a number of things, notably (for purposes of this labyrinth) five pieces of information – name, SSN/TIN, Address, Title, and Ownership Percentage – of up to five people that own 20 percent or more of the small business. And, according to the Interim Final Rule published on April 2nd, the lender (bank or credit union) can rely on that certification. And the authorized representative has to provide their name, title, and a signature.

So to summarize – for Title 15 SBA purposes, the borrower’s authorized representative needs to certify five pieces of information on as many as five legal owners of the borrower, and the bank lender can rely on that certification.

Title 31 Bank Secrecy Act (BSA) requirements

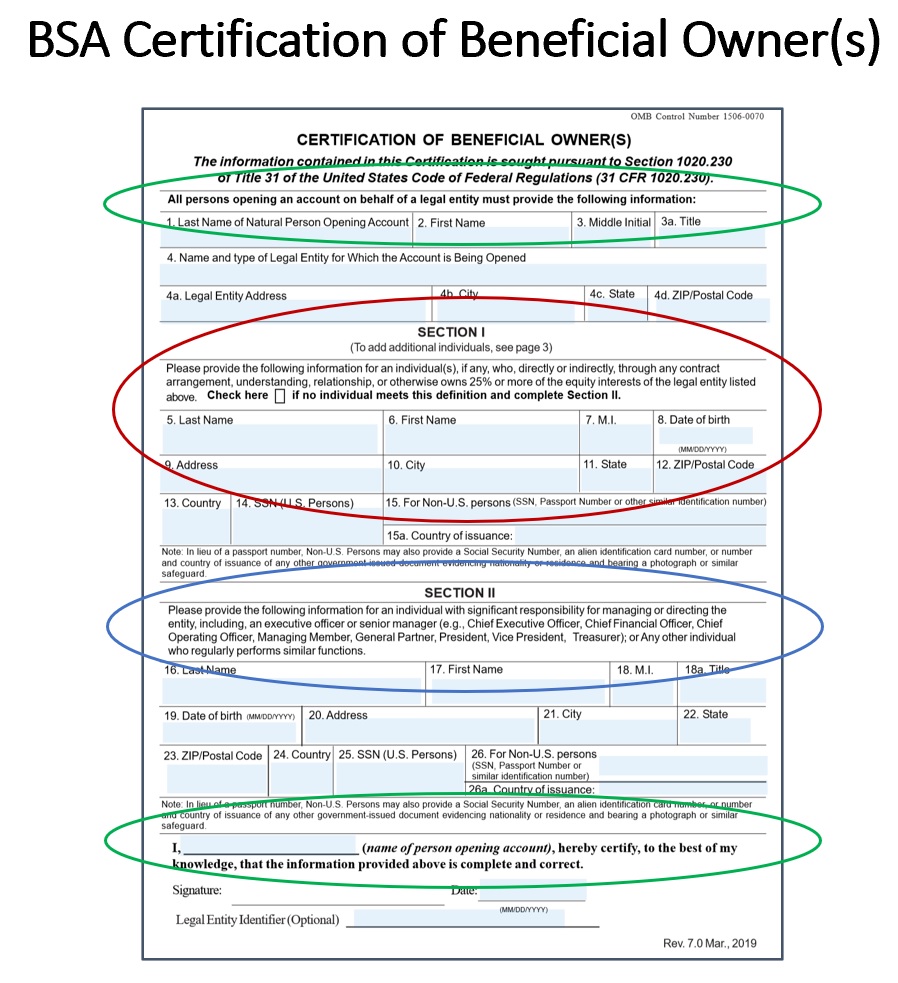

In May 2018 the federal anti-money laundering regulations were changed to add a requirement that financial institutions collect and verify “beneficial ownership” information of legal entity customers. Beneficial ownership was made up of what is called the “ownership prong” – a natural person owning twenty-five percent or more of the legal entity – and the “control prong” – one person who controlled the legal entity. The regulation also provided a Beneficial  Ownership Certification form. The result was that the person opening the account had to certify a number of things, notably (for purposes of this labyrinth) four pieces of information – name, SSN/TIN, address, and Date of Birth (DOB) – of up to five people: up to four that own twenty-five percent or more of the legal entity and the single “control” person. According to the regulation, the bank can rely on that certification ““provided that it has no knowledge of facts that would reasonably call into question the reliability of such information.” And the account opener has to provide their name, title, and a signature. And the bank is required to verify that beneficial ownership information: not that the persons are the beneficial owners, because that can’t reasonably be done, but that the persons are … persons. And that verification needs to be done within a reasonable time after the account is opened.

Ownership Certification form. The result was that the person opening the account had to certify a number of things, notably (for purposes of this labyrinth) four pieces of information – name, SSN/TIN, address, and Date of Birth (DOB) – of up to five people: up to four that own twenty-five percent or more of the legal entity and the single “control” person. According to the regulation, the bank can rely on that certification ““provided that it has no knowledge of facts that would reasonably call into question the reliability of such information.” And the account opener has to provide their name, title, and a signature. And the bank is required to verify that beneficial ownership information: not that the persons are the beneficial owners, because that can’t reasonably be done, but that the persons are … persons. And that verification needs to be done within a reasonable time after the account is opened.

And there are some complications in the BSA rule around existing customers opening new accounts, and whether the bank can rely on existing beneficial ownership information or not. Essentially, a bank needs to document whether and when and how it will it can rely on existing information, and that documentation is part of what is known as its “risk-based BSA compliance program”.

So to summarize – for Title 31 BSA purposes, the legal entity’s account opener needs to certify four pieces of information on as many as four legal owners and one control person, and the bank can rely on that certification unless it knows of something that calls into question the reliability of the information, and the bank needs to verify that the persons are, in fact, persons.

Title 31 BSA requirements for Title 15 SBA PPP Loans

On April 13 Treasury and the SBA revised previously published FAQs to add a question and answer relating to how the Title 31 BSA requirements relating to collection (and verification) of beneficial ownership information would be applied to the Title 15 SBA PPP loans. And FinCEN issued, for the first time, the same question and answer. These are summarized below:

Treasury FAQ: Does the information lenders are required to collect from PPP applicants regarding every owner who has a 20% or greater ownership stake in the applicant business (i.e., owner name, title, ownership %, TIN, and address) satisfy a lender’s obligation to collect beneficial ownership information (which has a 25% ownership threshold) under the BSA?

Existing customers: if the PPP loan is being made to an existing customer and the lender previously verified the necessary information, the lender does not need to re-verify the information. Furthermore, if federally insured banks and credit unions have not yet collected such beneficial ownership information on existing customers, such institutions do not need to collect and verify beneficial ownership information for those customers applying for new PPP loans, unless otherwise indicated by the lender’s risk-based approach to BSA compliance.

New customers: the lender’s collection of SIX THINGS – owner name, title, ownership %, TIN, address, and date of birth – from as many as 5 natural persons with a 20% or greater ownership stake in the applicant business will be deemed to satisfy applicable BSA requirements and FinCEN regulations governing the collection of beneficial ownership information. Decisions regarding further verification of beneficial ownership information collected from new customers should be made pursuant to the lender’s risk-based approach to BSA compliance.

Leaving aside (for the moment) the vexing issue of what a bank’s risk-based BSA compliance program requires it to do for existing high risk customers applying for PPP loans, the most elaborate labyrinth the government has created is for new customers. For these new-to-the-lender customers, there appears to be a trade-off. Purely for SBA purposes, PPP lenders need to collect but perhaps not verify SIX things – the name, TIN, DOB, address, title, and ownership percentage – one of which (DOB) isn’t on the PPP Form, for up to 5 natural persons as legal owners. The April 13th guidance doesn’t say anything about the BSA “control” person – nor does it say whether the SBA Authorized Representative can be that control person. And because a lender’s risk-based BSA compliance program requires it to verify beneficial owners, the PPP lender still needs to verify that the Beneficial Owners are, in fact, human beings … not that they are, in fact, the Beneficial Owners of the Applicant Borrower. Also, for both the BSA’s “person opening the account” and the SBA’s “Authorized Representative”, the financial institution must collect the person’s name, title, and signature.

A Possible Solution to Treasury’s Math Problem

The likelihood of rampant money laundering through PPP loans is pretty slim. The likelihood of fraud, though, is 100%. How much fraud is dependent on a lot of factors, but banks are adept at lending money and keeping fraud rates down. In normal times. These are not normal times. But everyone involved in this effort wants to get the $350,000,000,000 into the hands of deserving American small businesses as soon as possible, knowing that there will be some abuses, frauds, mistakes, corruption, laziness, willful blindness, etc., etc. in the process.

But making the lenders collect six pieces of information on the owners of small businesses when neither of the applicable regulatory regimes require them to collect more than five seems to add a layer of unnecessary complexity and can only slow down the lending process.

Having to collect 5 pieces of information (but not DOB) from as many as five legal owners for SBA purposes, and to collect four pieces of information (including DOB) from as many as four legal owners AND one control person for BSA purposes, and now to have to collect SIX pieces of information (including DOB) from five persons for SBA/BSA purposes creates confusion. Treasury needs to take its own risk-based approach: satisfy SBA requirements today, BSA requirements before you forgive the loan.

So here’s my suggestion to Treasury (and the regulatory agencies): PPP lenders can rely on the certifications in the Form 2483 PPP Borrower form. Those lenders can satisfy their BSA-related beneficial ownership requirements by the earlier of (i) September 30, 2020, or (ii) before the PPP loan is forgiven. In other words, focus on the PPP borrowers and requirements today, and worry about the BSA requirements later this summer. Full stop.