A couple of stealthy tweaks to the language in the rules for Round Paycheck Protection Program (PPP) loans will put an extra $6,300,000,000 (that’s $6.3 billion) in the hands of the lenders that they didn’t get for processing the same loans in Round One. Who slipped those changes in, and why? Were they even needed? Are there better approaches?

Let’s recap. The Paycheck Protection Program was first rolled out in April 2020. Congress made over $600 billion available through the Small Business Administration and the Treasury Department to, as the program’s name suggests, protect the paychecks of the owners and employees of the roughly 30 million small businesses in the United States through a program of loans that, if the loan proceeds were spent on payroll, rent or mortgage, and other listed business expenses, could be forgiven. And Congress enlisted private sector financial institutions to process these loans. To encourage participation, Congress and the SBA and Treasury set up a fee structure.

That fee structure was published in the Federal Register on April 15, 2020. It was pretty simple. SBA will pay lenders fees for processing PPP loans:

That fee structure was published in the Federal Register on April 15, 2020. It was pretty simple. SBA will pay lenders fees for processing PPP loans:

- For loans of not more than $350,000, a flat fee of five percent of the amount of the loan.

- For loans of more than $350,000 and less than $2,000,000, a flat fee of three percent of the amount of the loan.

- For loans of $2,000,000 or more (and the loans capped at $10,000,000), a flat fee of one percent of the amount of the loan.

So how did that work out for the roughly 5,200 lenders that participated in the Round 1 PPP?

According to SBA data, there were 5,212,128 PPP loans for just over $525 billion approved through August 8, 2020 (the end of the Round 1 program). Over 4.9 million, or 95 percent of PPP loans were for $350,000 or less, about 253,000 loans (about 5 percent) were for $350,000 to $2,000,000, and only 29,000 were for more than $2,000,000. Various articles (and my analysis) suggests that lenders received between $18 billion and $20 billion in fees for processing the Round 1 PPP loans.

3,574,110 PPP loans for $50,000 or less, averaging $17,555

Almost 69 percent of the PPP Round 1 loans were for $50,000 or less. It is these smallest loans – $50,000 or less – that I will focus on (you’ll see why shortly). At a flat fee of 5% of the face amount of the loan, the total fees paid to the lenders for these loans was $3,137,128,300. The average fee was $878 based on the average loan size of $17,555. What were lenders required to do to earn this fee?

According to the Interim Final Rule issued on April 15, 2020 (the 2020 IFR), borrowers submitted an application form to their lender (or a loan processor such as Kabbage or BlueVine) that included documents confirming the details of the business, including the beneficial owners, the employees and payroll, and a series of certifications that, essentially, the employees existed, were paid what was set out in the form, that they needed the proceeds to continue in business through the pandemic, and that they were not then under indictment or had recently been convicted of a felony. With that application, documentation, and certifications, the 2020 IFR required lenders to:

- Confirm receipt of borrower certifications contained in Paycheck Protection Program Application form;

- Confirm receipt of information demonstrating that a borrower had employees for whom the borrower paid salaries and payroll taxes on or around February 15, 2020;

- Confirm the dollar amount of average monthly payroll costs for the preceding calendar year by reviewing the payroll documentation submitted with the borrower’s application; and

- Follow applicable BSA requirements around customer due diligence

Importantly, the IFR provided that “a lender may rely on any certification or documentation submitted by an applicant for a PPP loan”. And when it came to forgiveness of the loan, the 2020 IFR provided that lenders can rely on the borrower’s documentation for loan forgiveness:

“The lender does not need to conduct any verification if the borrower submits documentation supporting its request for loan forgiveness and attests that it has accurately verified the payments for eligible costs. The Administrator will hold harmless any lender that relies on such borrower documents and attestation from a borrower. The Administrator, in consultation with the Secretary, has determined that lender reliance on a borrower’s required documents and attestation is necessary and appropriate in light of section 1106(h) of the Act, which prohibits the Administrator from taking an enforcement action or imposing penalties if the lender has received a borrower attestation.”

So although a lender’s obligations weren’t particularly onerous for either the loan origination or forgiveness, and a lender has almost no liability if the borrower’s certifications or documentation were fraudulent, a flat five percent fee for the majority of the loans may not have covered all of the costs incurred by the lenders.

So changes were made.

The PPP program was reconstituted with the Economic Aid Act in late December 2020. More funds were allocated by Congress, the Round 2 lending began again in mid-January. And the rules for Round 2 were issued on January 6, 2021 (“2021 IFR”).

The 2021 IFR added some interesting language and made some significant changes to the fee structure.

The lenders’ obligations (the four bullets above) did not change. As far as loan forgiveness goes, the language was subtly changed from “the lender does not need to conduct any verification if the borrower submits documentation supporting its request for loan forgiveness and attests that it has accurately verified the payments for eligible costs” to “the lender does not need to independently verify the borrower’s reported information if the borrower submits documentation supporting its request for loan forgiveness and attests that it accurately verified the payments for eligible costs.”

In addition, this paragraph was added:

“With respect to a lender that relies on such a certification or documentation related to a PPP loan, an enforcement action may not be taken against the lender, and the lender shall not be subject to any penalties relating to loan origination or forgiveness of the PPP loan, if— (A) the lender acts in good faith relating to loan origination or forgiveness of the PPP loan based on that reliance; and (B) all other relevant Federal, State, local, and other statutory and regulatory requirements applicable to the lender are satisfied with respect to the PPP loan.”

And in a footnote, this expansive hold harmless for both origination and forgiveness was retroactively applied to Round 1 PPP loans. So it appears that Congress expanded the “hold harmless” benefit from an enforcement action taken by the SBA Administrator, to an enforcement action brought by any federal agency … as long as the lender acted “in good faith relating to loan origination or forgiveness of the PPP loan based on that reliance” (whatever that means, and whatever “good faith” means!).

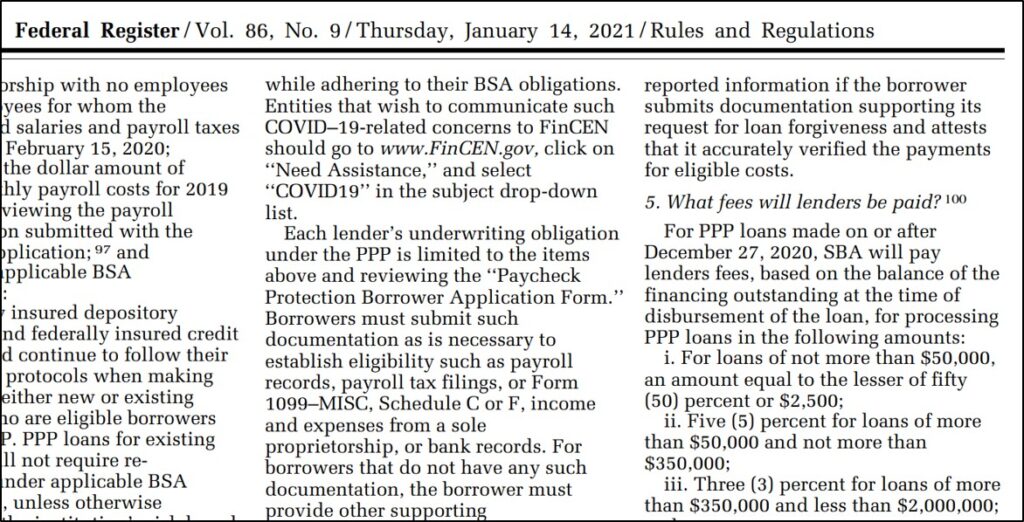

So compared to Round 1 loans, Round 2 PPP lenders had roughly the same obligations, were given slightly less responsibility, and were provided greater protections. What about their fees? The 2021 IFR provided that for Round 2 PPP loans, SBA will pay lenders fees, based on the balance of the financing outstanding at the time of disbursement of the loan, for processing PPP loans in the following amounts:

- For loans of not more than $50,000, an amount equal to the lesser of fifty (50) percent or $2,500;

- Five (5) percent for loans of more than $50,000 and not more than $350,000;

- Three (3) percent for loans of more than $350,000 and less than $2,000,000; and

- One (1) percent for loans of at least $2,000,000.

The fees for loans of more than $50,000 – 31.4% of the loans made in 2020 – remain the same for Round 2. The difference for the loans of $50,000 or less seems subtle: changed from a flat fee of 5 percent of the loan amount to “an amount equal to the lesser of fifty (50) percent or $2,500.”

For the math-challenged among us, this could take some time (and pencil and paper) to figure out. But the result isn’t difficult to determine:

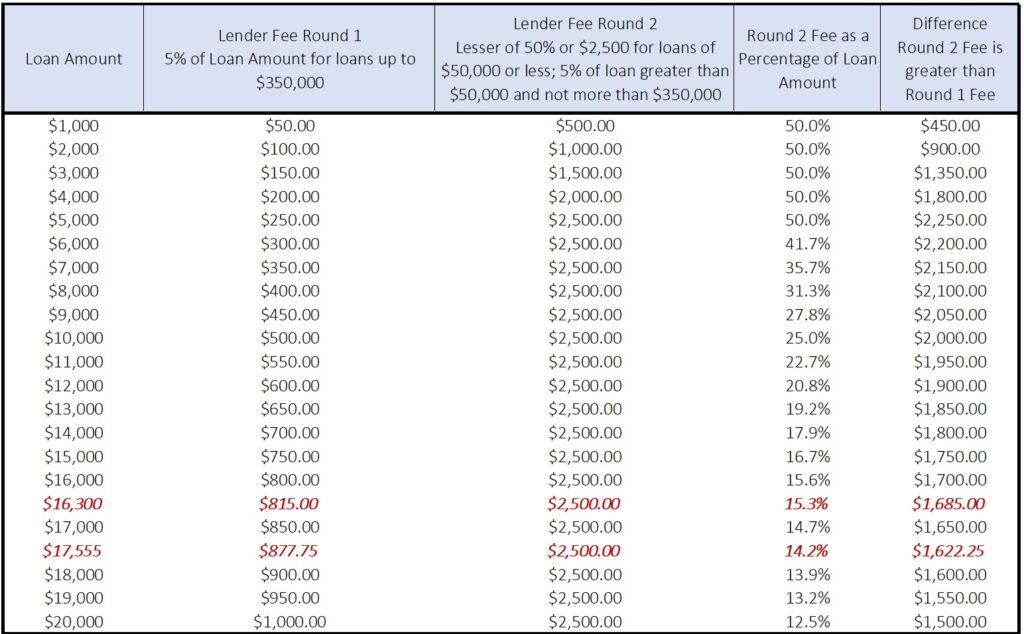

The new small dollar PPP loan fee structure may put an extra six billion dollars in lenders’ pockets

A fee of the lesser of 50 percent of the loan amount, or $2,500, means that a loan of up to $5,000 will have a fee of 50 percent, then from $5,000 to $50,000 the fee percentage goes down from 41.7 percent to 5.0 percent. The table below is a snapshot of the difference in fees for small dollar loans: highlighted are two loan amount – $16,300 and $17,555, with the former being the average loan amount for all Round 2 loans of $50,000 or less, and the latter being  the average loan amount for all Round 1 loans of $50,000 or less. At the average Round 1 loan amount of $17,555, the fee is $2,500, or 14.2 percent of the amount of the loan.

the average loan amount for all Round 1 loans of $50,000 or less. At the average Round 1 loan amount of $17,555, the fee is $2,500, or 14.2 percent of the amount of the loan.

When multiplied across almost 3.6 million Round 1 loans of $50,000 or less, the difference in total fees paid is stark: the Round 1 fee structure put about $3.14 billion into lenders’ pockets; if the Round 2 fee structure had been used for those loans, lenders would have received just over $8.9 billion, a difference of almost $5.8 billion – actually $5,798,146,700.

So how many Round 2 PPP loans have this enhanced fee structure, and how much extra have American taxpayers paid as a result?

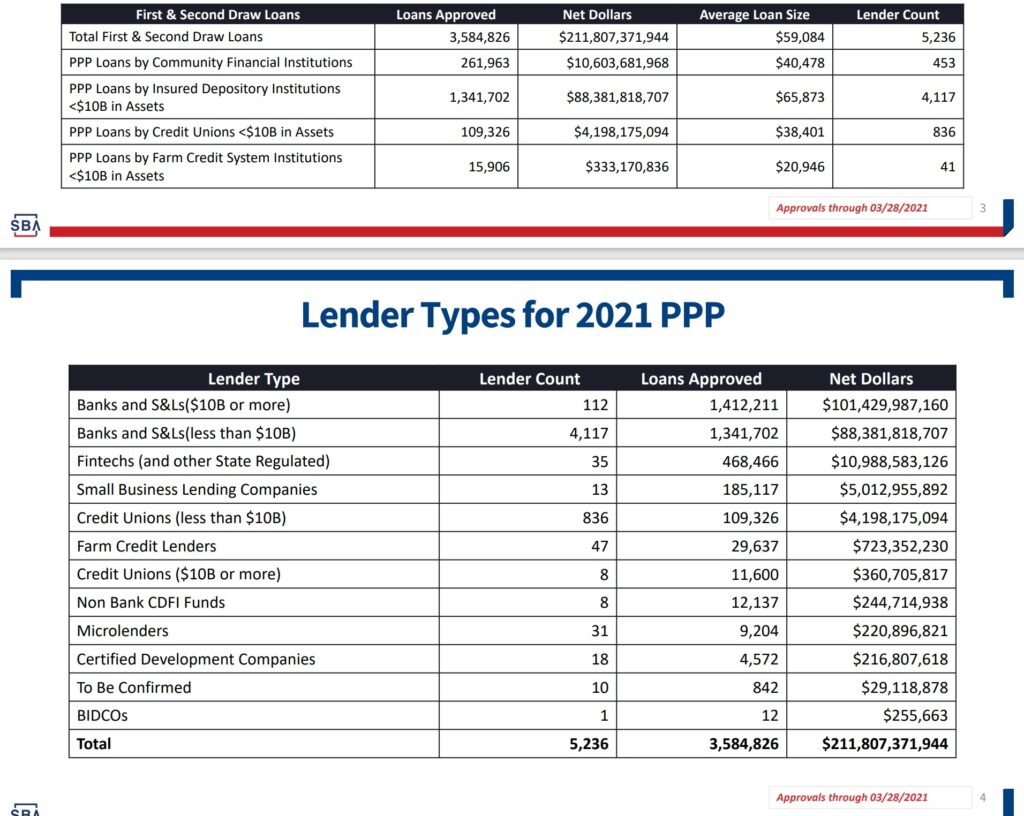

SBA has published Round 2 PPP data through March 28, 2021. That data shows that 5,236 lenders have processed a total of 3,584,826 PPP loans for about $212 billion. The average Round 2 PPP loan is just over $59,000 (compared to the average Round 1 PPP loan of $101,000). Of those, 2,812,113 loans are for $50,000 or less totaling about $45.8 billion. The average loan amount of these small dollar loans is $16,300 (that amount is also highlighted in the table above).

The average fee for the small dollar Round 2 PPP loans is $2,500, or 15.3 percent of the amount of the loan. Compare this to the Round 1 fee of $815.00. Multiplied across the 2.8 million Round 2 loans of $50,000 or less, and American taxpayers have paid an extra $4,738,410,405 that they would not have paid in Round 1 for the same loans.

Congress appropriated $284 billion for PPP Round 2 loans. As of March 28th, $212 billion had been funded (about 75 percent of the amount available). If all $284 billion is funded, this revised fee structure will cost American taxpayers over $6 billion in extra fees.

Six Billion Dollars Used To Be A Lot of Money

I’m sure that PPP lenders will argue that $878 in fees didn’t begin to cover their costs of processing the small dollar loans (let alone processing the applications for forgiveness of those loans that they’ll also have to perform), and it was the small dollar loans that went to the most vulnerable small businesses and sole proprietors that really needed the financial aid in order to survive the pandemic. But for American taxpayers to pay $2,500 to a lender to process a $16,300 loan seems excessive, particularly given the obligations those lenders had in processing the loan: electronically take in the loan application form and supporting documentation, confirm the borrower’s math and certifications, submit the documents to the SBA, and cut a check to the borrower for the loan amount. And they can rely on the borrower’s certifications and documentation without fear of an enforcement action if they, as long as they act in good faith.

Two better approaches – either cut out the middleman altogether, or limit the increased fees to the smallest lenders

It’s too late to change the fee structure for this pandemic. But there will be another pandemic. Here are my suggestions to save American taxpayers anywhere from $3 billion to $6 billion.

First, cut out the middleman altogether! The SBA has already done that with the Economic Injury Disaster Loan (EIDL) program. Those are pandemic loans of up to $150,000 (that also come with grants of $1,000 per employee up to $10,000) that are processed directly by the SBA, without using the private sector lender or “middleman”. Why not do the same thing for the small dollar PPP loans? Very little true underwriting is done anyway on PPP loans of $50,000 or less, so why not have the computers and algorithms of the SBA handle these loans directly?

One reason is that a lot of the lenders are small enterprises themselves that have also been hurt by the pandemic, so giving them an income stream and potential new customers is a positive outcome for the fees that they earn.

Which leads me to my second suggestion: give the enhanced fees only to the smallest lenders.

How many of the PPP lenders are smaller enterprises? It may be easier to count the number of PPP lenders that are not small enterprises. Based on SBA data, it appears that there are 120 banks and credit unions with assets of $10 billion or more that have processed about 40 percent of the Round 2 loans for almost half (48 percent) of the amount loaned to date. Those mega institutions don’t need the Government’s help – at least not through increased fees for small dollar, government-secured loans where they aren’t required to do any sophisticated underwriting and have virtually zero liability. So for these institutions I would keep the fees as they were for Round 1 – 5 percent for all loans under $350,000.

We may not save the full $6.3 billion next time, but we could save about half that amount. After all, three billion dollars used to be a lot of money.