Marijuana-Related Businesses may have greater access to financial services than is being reported, even if those services aren’t being provided by banks and credit unions

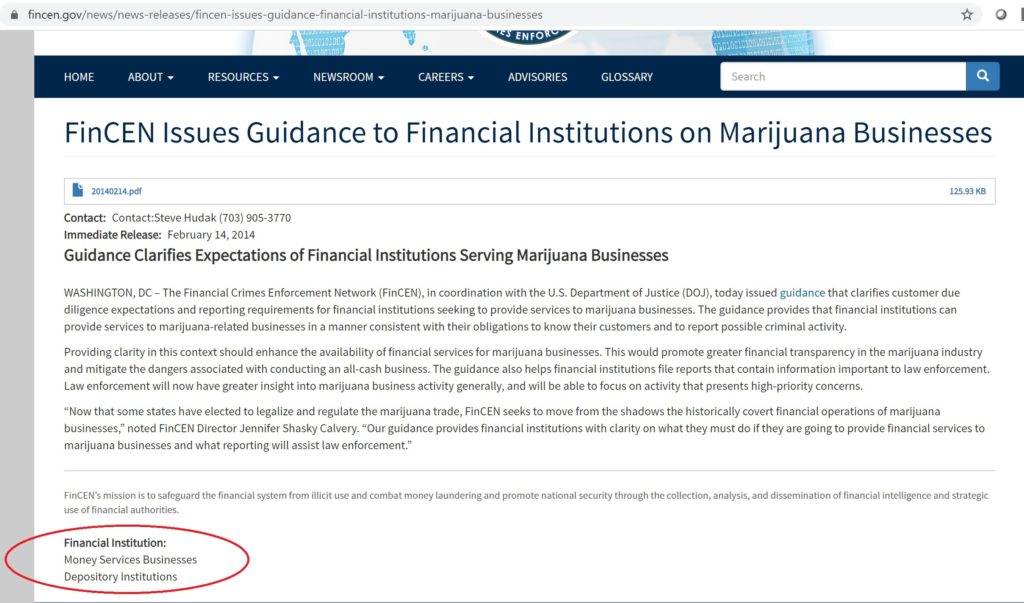

The only real guidance that financial institutions can turn to when deciding whether to provide financial services to marijuana-related businesses, or MRBs, is FinCEN’s February 14, 2014 guidance, FIN-2014-G001. The actual Guidance document – FIN-2014-G001 PDF – begins with: “The Financial Crimes Enforcement Network (“FinCEN”) is issuing guidance to clarify Bank Secrecy Act (“BSA”) expectations for financial institutions seeking to provide services to marijuana-related businesses.”

The section “Providing Financial Services to Marijuana-Related Businesses” begins with “This FinCEN guidance clarifies how financial institutions can provide services to marijuana-related businesses consistent with their BSA obligations. In general, the decision to open, close, or refuse any particular account or relationship should be made by each financial institution based on a number of factors specific to that institution.” Following that is a section on seven marijuana-related business-specific customer due diligence steps a financial institution should consider in assessing the risk of providing services to a marijuana-related business. Then there is guidance on the three types of marijuana-related Suspicious Activity Reports: Marijuana Limited, Marijuana Priority, and Marijuana Termination. Finally, there are two pages of “Red Flags to Distinguish Priority SARs”.

Throughout the Guidance, the term “financial institution” is used forty-four times in seven pages. The term “money services business” or “MSB” appears once (in the PDF version of the Guidance). In the “Currency Transaction Reports and Form 8300’s” section on the last page is: “Financial institutions and other persons subject to FinCEN’s regulations must report currency transactions in connection with marijuana-related businesses the same as they would in any other context, consistent with existing regulations and with the same thresholds that apply. For example, banks and money services businesses would need to file CTRs on the receipt or withdrawal by any person of more than $10,000 in cash per day.”

So, are MSBs covered by the 2014 Guidance or not? Are MSBs “financial institutions” and subject to the Guidance?

For BSA purposes, the term “financial institution” is defined in the regulations at 31 CFR s. 1010.100 as including banks, credit unions, broker dealers, casinos, mutual funds, and money services businesses, among other entities. So one could assume that the use of that term in the Guidance indicated that all entity types would be subject to the guidance – including money services businesses, broker dealers, casinos, card clubs, etc.

Although the PDF version of the FinCEN Guidance doesn’t define “financial institution”, both the news release and the non-PDF version had a reference to the term “Financial Institution” at the end (of both) that appears to mean that for the purposes of the “Guidance to Financial Institutions on Marijuana Businesses”, “financial institutions” meant money services businesses and depository institutions.

The term “depository institution” is defined in multiple banking regulations in Title 12 of the Code of Federal Regulations. To keep it simple, and in keeping with FinCEN’s reporting practices, it means banks and credit unions. So, according to FinCEN, it has issued guidance to clarify Bank Secrecy Act (“BSA”) expectations for banks, credit unions, and money services businesses seeking to provide services to marijuana-related businesses.

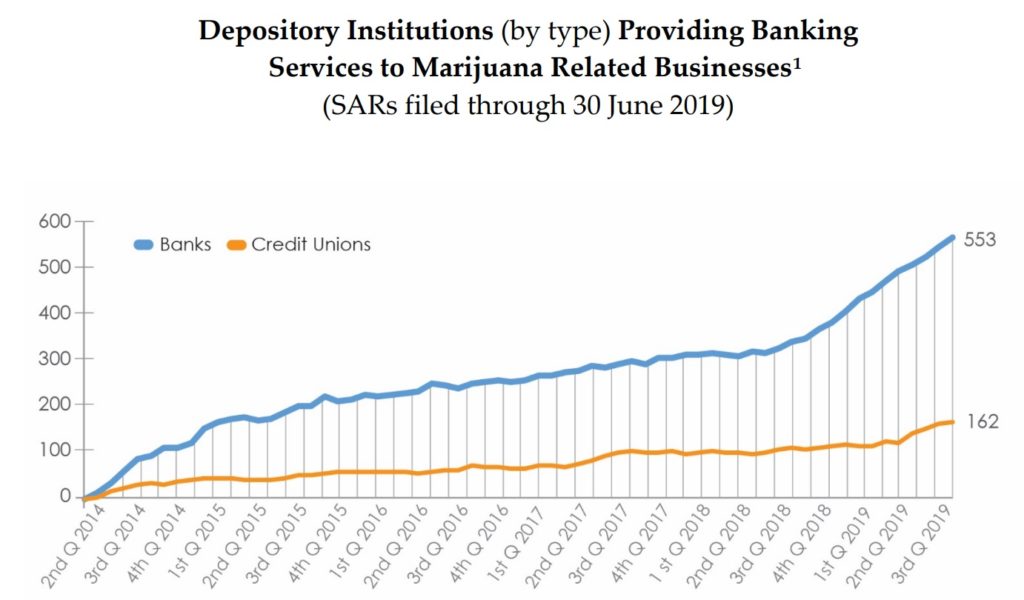

Since the publication of the that guidance, FinCEN has published a quarterly “Marijuana Banking” report that provides some high level data on the number of these marijuana-related SARs that it instructed depository institutions (banks and credit unions) and money services businesses to file. As can be seen from the chart, this reporting is limited to depository institutions – banks and credit unions. FinCEN hasn’t reported any marijuana-related SARs filed by any of the other “financial institution” types – money services businesses.

Since the publication of the that guidance, FinCEN has published a quarterly “Marijuana Banking” report that provides some high level data on the number of these marijuana-related SARs that it instructed depository institutions (banks and credit unions) and money services businesses to file. As can be seen from the chart, this reporting is limited to depository institutions – banks and credit unions. FinCEN hasn’t reported any marijuana-related SARs filed by any of the other “financial institution” types – money services businesses.

If FinCEN has provided guidance that banks, credit unions, and money services businesses are required to file marijuana-related SARs, why is it only reporting on the marijuana-related SARs filed by banks and credit unions?

Without knowing for sure whether any of the 227,745 MSBs (according to a GAO report released September 26, 2019 that looked at how BSA-related information was being shared between the public sector agencies and by FinCEN: see GAO-19-582 at page 9) have identified and reported any marijuana-related suspicious activity, one can assume that some of the millions of SARs filed by those MSBs since 2nd quarter 2014 must have included marijuana-related activity. Indeed, given the complaints by the cannabis/marijuana industries about the lack of access to traditional banking services, one can assume that marijuana-related businesses are turning to money services businesses and alternative financial services providers to conduct otherwise basic financial services such as paying suppliers, paying utility providers, paying taxes and license fees, even cashing checks for employees. And, if those marijuana-related businesses were doing those transactions at money services businesses, ALL of those transactions are supposed to be reported in a marijuana SAR. According to FinCEN.

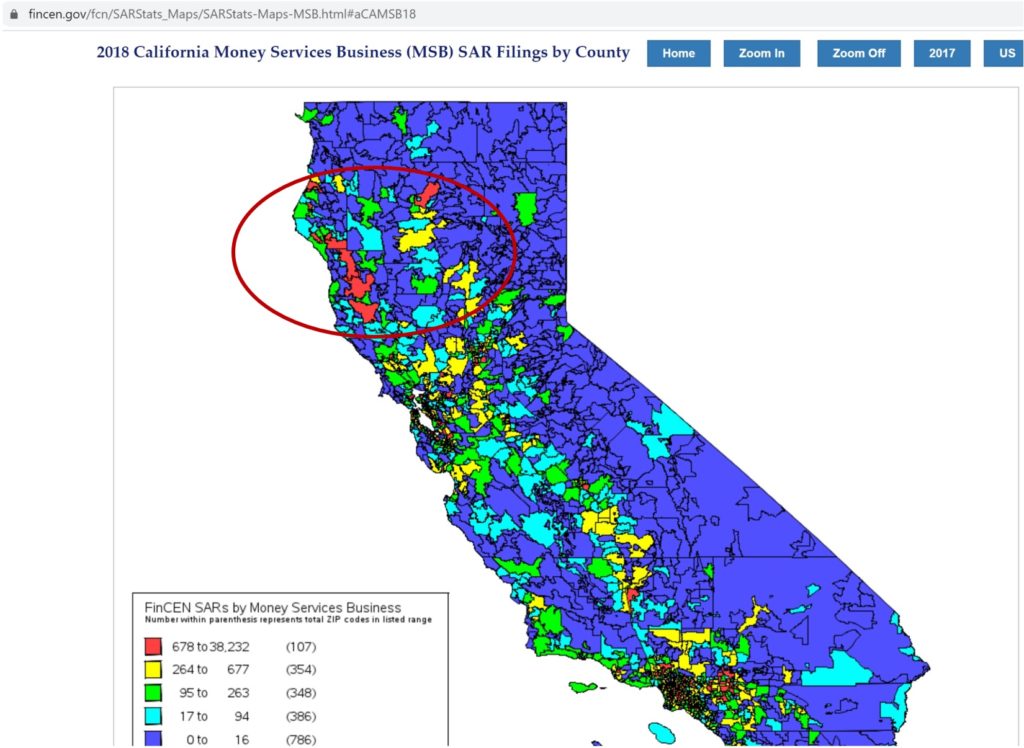

The data may bear that out. FinCEN’s SAR Statistics allow you to drill down to SARs filed by depository institutions, by MSBs, by month and year, and by location of the reported suspicious activity (state, county, even metropolitan areas). See https://www.fincen.gov/reports/sar-stats

Let’s take a look at a marijuana hot spot – the Emerald Triangle of California: Humboldt, Trinity, and Mendocino counties that (reportedly) grow much of the illegal cannabis in California and about 35% of the legal cannabis.

In calendar year 2018, across all of the United States, MSBs filed about 90 SARs for every 100 SARs filed by Depository Institutions, or DIs. But for activity that occurred in California,  MSBs filed 122 SARs for every 100 SARs filed by DIs. To put it another way, for suspicious activity across the United States, MSBs filed about 90% the number of SARs as banks and credit unions, but in California MSBs filed 122% the number of SARs as did DIs. But according to FinCEN’s “heatmap” of SARs filed by MSBs by California county, there was a hotspot up in the three “Emerald Triangle” counties. Drilling down into the actual FinCEN data, in 2018 MSBs filed 327 SARs (10,076) for every 100 SARs (3,081) filed by DIs in the three Emerald Triangle counties. There are only 235,000 people in those three counties, which is 0.6% of California’s population, yet 4.6% of MSBs’ SARs were filed on activity that occurred in those three counties.

MSBs filed 122 SARs for every 100 SARs filed by DIs. To put it another way, for suspicious activity across the United States, MSBs filed about 90% the number of SARs as banks and credit unions, but in California MSBs filed 122% the number of SARs as did DIs. But according to FinCEN’s “heatmap” of SARs filed by MSBs by California county, there was a hotspot up in the three “Emerald Triangle” counties. Drilling down into the actual FinCEN data, in 2018 MSBs filed 327 SARs (10,076) for every 100 SARs (3,081) filed by DIs in the three Emerald Triangle counties. There are only 235,000 people in those three counties, which is 0.6% of California’s population, yet 4.6% of MSBs’ SARs were filed on activity that occurred in those three counties.

It could be that none of those 10,076 MSB SARs filed in 2018 on activity that occurred in the Emerald Triangle counties was flagged as a marijuana-related SAR for FinCEN to identify, track, and report. But the ratio of MSB-related SARs relative to the number of bank and credit union related SARs filed on activity in the Emerald Triangle – a ratio that has held steady for the last five years at 3.5 to 1 – suggests that FinCEN’s quarterly “Marijuana Banking” report of marijuana-related SARs filed by banks and credit unions may be under-reporting marijuana-related financial activity overall.

It’s logical – and likely – that this high MSB SAR count, both relative to depository institutions and to the population of the area, indicates that MSBs are filing “Marijuana Limited” SARs on all of the activity that marijuana-related businesses are doing with them, not just the traditional suspicious activity. In other words, MSBs are complying with the FinCEN guidance, and we don’t know it. The conclusion may be that marijuana related businesses have access to more financial services than is being reported, even if those financial services aren’t being provided by banks and credit unions.

Perhaps FinCEN can tell us in the next quarterly Marijuana Banking and Money Services Business Report …