A call to action for all US financial institutions!

On May 7, 2019, FinCEN published a “Notice and Request for Comments” in the Federal Register that sought comments from the public on its renewal, without change, of the 314(a) Program … the program created by section 314(a) of the USA PATRIOT Act of 2001, and established by regulations published on September 26, 2002, where law enforcement, through FinCEN, can ask covered financial institutions to search their customer and transactional records for names of persons and entities believed to be involved in terrorist financing or money laundering.

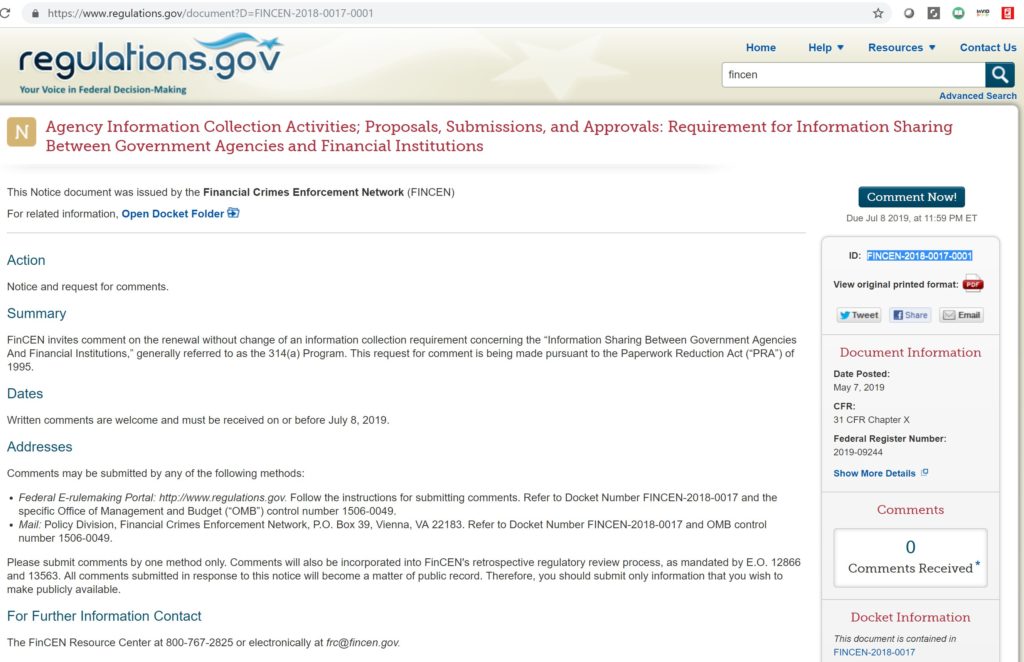

The notice is at https://www.regulations.gov/document?D=FINCEN-2018-0017-0001 but I couldn’t find any reference on FinCEN’s website to indicate that it published the Notice and Request for Comments.

The original 2002 regulation gave federal law enforcement agencies the ability to use 314(a). The regulation was revised in 2010 to give certain non-federal law enforcement entities access to 314(a). This Notice and Request for Comments only applies to the non-federal law enforcement entities: footnote 4 on page 20000 of the Federal Register notice provides ” this renewal applies only to the use of the 314(a) Program with respect to queries initiated by non-Federal law enforcement entities.”

Under the Paperwork Reduction Act, each such notice requires a statement of how many entities are affected by the notice or proposed rule, and how much time each of those entities will take to comply.

Here’s where it gets interesting …

14,463 financial institutions receive 314(a) requests that come from non-federal law enforcement agencies

FinCEN writes that “On an annual basis, there are approximately 14,643 covered financial institutions, consisting of certain commercial banks, savings associations, and credit unions, securities broker-dealers, future commission merchants, certain trust companies, life insurance companies, mutual funds and money services businesses.” (footnote 5)

And how many 314(a) requests does FinCEN send to these 14,463 financial institutions that do not originate with federal law enforcement agencies?

FinCEN sends ninety (90) requests a year under section 314(a) that do not originate with federal law enforcement agencies

Footnote 6 provides the details: “Estimated cases/subjects per annum subject to the [Paperwork Reduction Act] include, 10 from FinCEN, 50 from state/

local law enforcement, and 30 from European Union countries approved by treaty, for a total of 90 requests per annum, with each request containing an average of 7 subjects (including aliases).”

How much time is spent responding to each request?

According to FinCEN, it takes a bank 4 minutes on average to determine if a 314(a) name is a match on its customer and transactional systems

Footnote 6 continues with this: “Each subject requires 4 minutes to research, resulting in (90 × 7 × 4 ÷ 60) = 42 hours per year.”

Does it really take only 4 minutes to scour bank records to determine if there is a match?

What does the 314(a) regulation require of financial institutions? 31 CFR s.1010.520(b)(3) sets out the two “obligations of a financial institution receiving an information request” – searching records and, if there is a name match, to report to FinCEN:

(i) Record search. Upon receiving an information request from FinCEN under this section, a financial institution shall expeditiously search its records to determine whether it maintains or has maintained any account for, or has engaged in any transaction with, each individual, entity, or organization named in FinCEN’s request. A financial institution may contact the law enforcement agency, FinCEN or requesting Treasury component representative, or U.S. law enforcement attaché in the case of a request by a foreign law enforcement agency, which has been named in the information request provided to the institution by FinCEN with any questions relating to the scope or terms of the request. Except as otherwise provided in the information request, a financial institution shall only be required to search its records for:

(A) Any current account maintained for a named suspect;

(B) Any account maintained for a named suspect during the preceding twelve months; and

(C) Any transaction, as defined by §1010.505(d), conducted by or on behalf of a named suspect, or any transmittal of funds conducted in which a named suspect was either the transmittor or the recipient, during the preceding six months that is required under law or regulation to be recorded by the financial institution or is recorded and maintained electronically by the institution.

(ii) Report to FinCEN. If a financial institution identifies an account or transaction identified with any individual, entity, or organization named in a request from FinCEN, it shall report to FinCEN, in the manner and in the time frame specified in FinCEN’s request, the following information:

(A) The name of such individual, entity, or organization;

(B) The number of each such account, or in the case of a transaction, the date and type of each such transaction; and

(C) Any Social Security number, taxpayer identification number, passport number, date of birth, address, or other similar identifying information provided by the individual, entity, or organization when each such account was opened or each such transaction was conducted.

So … given a name, the financial institution needs to search all of its customer systems going back twelve months, and all of its transaction systems going back six months, to look for name matches and, if there is a match, to report back to FinCEN. This process takes much longer than four minutes.

The most important part of the entire Notice came at the end of footnote 6, where FinCEN wrote: “For the 2016 renewal of this information collection, FinCEN did not receive any public comments regarding the estimate of 4 minutes.”

Action Required – Financial Institutions, Let FinCEN Know How Long It Takes to Comply With 314(a) Requests!

I strongly urge financial institutions to submit comments to FinCEN by the deadline date of July 8, 2019, to let it know how long it actually takes to comply with 314(a) requests.