The U.S. Treasury Department has tapped into the largest open database of companies in the world, but that database does not include beneficial ownership information on US companies

The U.S. Treasury Department has tapped into the largest open database of companies in the world, but that database does not include beneficial ownership information on US companies

The simple reason that the OpenCorporates database of companies does not include beneficial ownership information on US companies is that this information is not available. None of the fifty states require and record legal entities’ beneficial owners.

The Corporate Transparency Act, part of the Anti-Money Laundering Act of 2020 which in turn is part of the National Defense Authorization Act for Fiscal Year 2021, attempted to remedy this, but fell short. The Corporate Transparency Act, or CTA, requires the Treasury Department’s Financial Crimes Enforcement Network, or FinCEN, to build a “secure, nonpublic database” with “the highest security level” that will contain certain beneficial ownership information on a designated subset of US companies (estimates vary, but there may be as many as 30 million US companies, with about 4 million new ones created every year). The beneficial ownership information – the names and some identifying information on up to four legal owners and at least one person with control of the entity – will be provided by those entities – called reporting companies. The beneficial ownership information will be available (with all sorts of checks and balances and limitations), to certain federal, state, tribal, and local law enforcement agencies, some federal regulatory agencies, and any financial institution that has regulatory customer due diligence obligations (with the permission of its reporting company customer). The FinCEN Beneficial Ownership Information (BOI) Registry will not be open to the public.

Once built, the FinCEN BOI Registry will be the second corporate database that FinCEN has access to, but it will be the first one that it is required to design, build, and maintain and the first one focused solely on beneficial ownership information.

FinCEN, as part of the Treasury Department’s Office of Terrorist Financing and Financial Crimes (also known as the Office of Terrorism and Financial Intelligence, or TFI), appears to have access to an even more comprehensive database of corporate information on as many as 200 million companies from around the world.

At page 11 of TFI’s budget request to Congress for fiscal year 2022 https://home.treasury.gov/system/files/266/06.-TFI-FY-2022-CJ.pdf is the following:

“The Office of Terrorist Financing and Financial Crimes-led Illicit Finance Fusion Cell (IFFC), an interagency body established in 2018 to use advanced data analytics and public records in support of Treasury’s national security priorities, partnered closely with the TFI Chief Data Officer to acquire and ingest over 300 million corporate records into the TFI data platform. The IFFC’s methodology prioritizes detecting anomalous patterns in publicly available data (PAI) that are both indicative of illicit activity and uncover new information previously unknown to the interagency community. The IFFC expanded in 2020 beyond its original focus on Iran to produce analysis of corporate networks conducting illicit activity, including corruption, bribery, and other financial crimes, in support of rogue actors in China, Russia, Lebanon, Syria, Bahrain, Venezuela, Malta, and Turkey. The IFFC’s unique methodology detected previously unreported illicit or suspicious activity, enhanced foreign engagement, and informed targeting efforts.” (emphasis added)

From this, it appears that Treasury’s Office of Terrorist Financing and Financial Crimes has access to and is using over 300 million corporate records. Where did they get that information? My first thought was that Open Corporates has that type and scope of data, and makes it available to the public (for a fee). I ran my idea past Adam Mulliken, PhD, the Senior Vice-President of Product for Quantifind, a global leader in financial crimes compliance technology for both the public and private sectors. Adam pointed me to an Open Corporates podcast from September 16, 2021 titled “Transparent Company Data & Investigations”. In this podcast, Shanti Salas, Vice President at OpenCorporates spoke to Todd Conklin, Chief Data Officer and Chief Information Officer at the US Department of the Treasury’s Office of Terrorism and Financial Intelligence about the role of transparent company data in investigations. They discussed, among other things, how transparent company data enables investigations, the importance of data provenance, and enabling new insights in investigations. Todd Conklin noted that for information security and data provenance reasons, Treasury needs to bring public data into Treasury’s systems (rather than pulling it in from the provider of the data). This statement lines up with what was written in the FY2022 budget request that the Illicit Finance Fusion Cell partnered with the TFI Chief Data Officer to “acquire and ingest over 300 million corporate records into the TFI data platform”. Beginning at the 2:56 mark, Todd Conklin stated:

“What’s key about the Open Corporates dataset that is provided to us, it maps really cleanly with what we call anti-money laundering and know your customer data ontology which is pretty widely used across the financial sector but also within the Treasury Department where all of our data on the back end we map to that specific ontology. And it includes things that logically anyone would want to know about a company registration: who are the owners behind the company – their individual names – where the company is located, how long it has been in existence …”. (emphasis added)

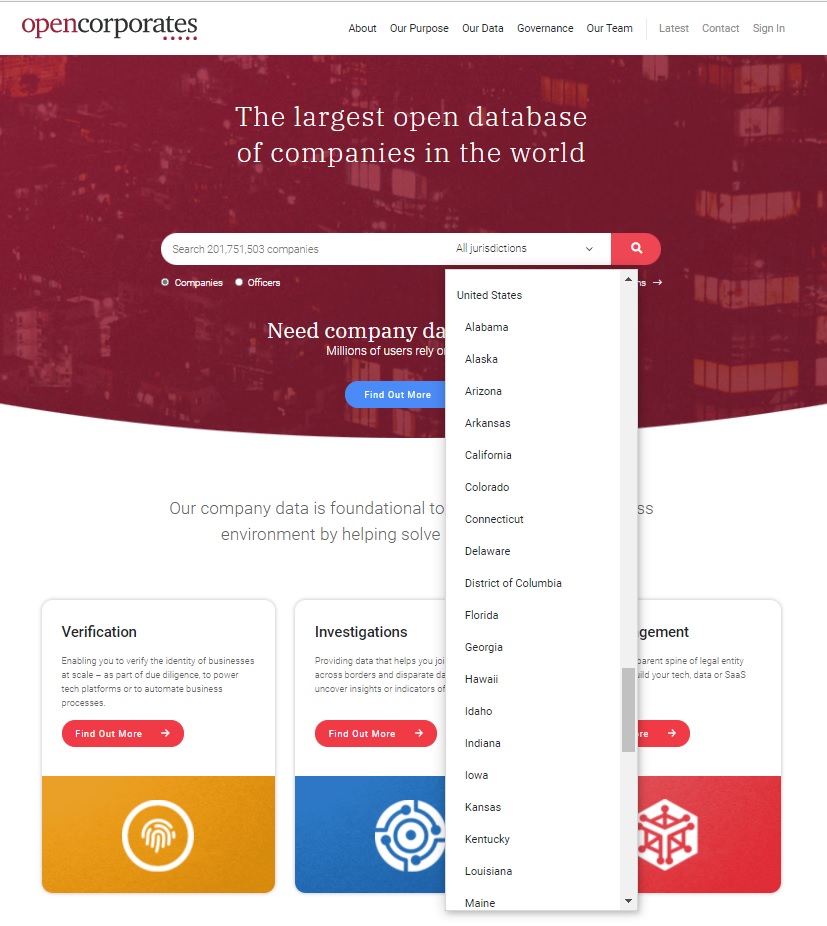

As of October 1, 2019 Open Corporates celebrated a “company count” of 180 million records. See https://blog.opencorporates.com/2019/10/01/one-hundred-and-eighty-million-another-minor-milestone/, and its website currently indicates it has data on over 201 million companies from 140 countries. https://opencorporates.com (accessed November 19, 2021).

So it appears that if and when the Corporate Transparency Act’s Beneficial Ownership Information database is built and operational, FinCEN will have access to two databases of such information: one containing 10-30 million American reporting companies (as reported by those companies) containing the beneficial ownership information of those companies, and one containing information on over 201 million companies from around the world, including the United States, populated by Open Corporates. And as Open Corporates points out, its data comes from primary public sources, with links to those sources, such as the fifty US states’ company formation records. But those records do not include beneficial ownership information.