The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) was signed into law by the President on March 27, 2020. It is a stunning piece of legislation meant to support our first responders and medical personnel treating those that are stricken, and to provide emergency economic relief to individuals, small businesses, and even large corporations that have been so adversely impacted by the pandemic.

The ink was barely dry on the CARES Act (enacted March 27th), which created the $349 billion Small Business Administration’s Paycheck Protection Program loan program, when the Interim Final Rules were published (April 3rd). Those PPP loans will be doled out by qualified lenders to qualified Applicants, in increments of up to $10 million per Applicant (limit of one per Applicant). Those loans will bear interest at 1% per year, with interest and principle payments deferred for six months and – here’s the best part – the Government will forgive “qualifying” loans.

As of 7:00 am PST on April 7th, there were about 1,800 lenders that had previously been approved, and another 600 or so that have only recently been approved, to act as SBA PPP lenders. How will they be compensated?

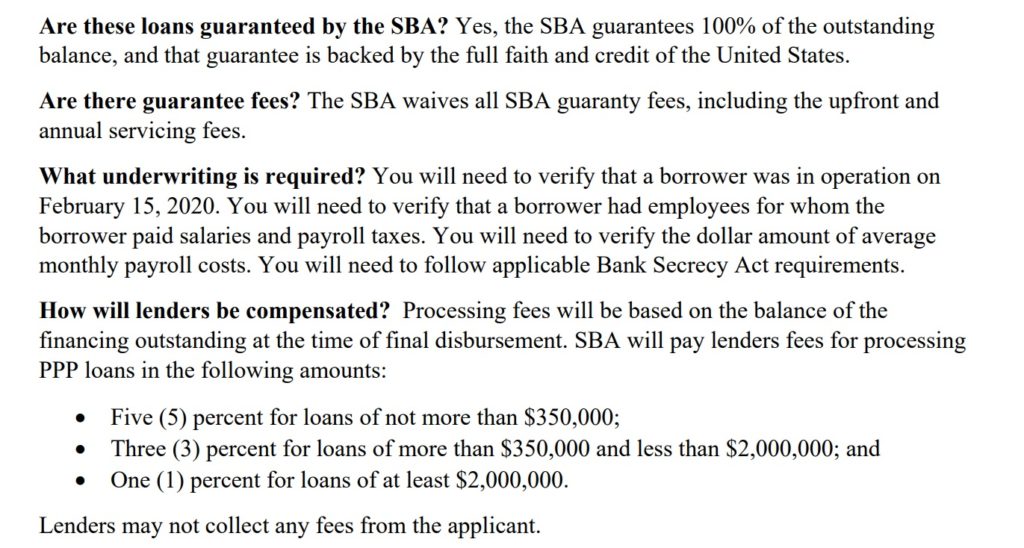

According to the Treasury Department’s Treasury PPP Fact Sheet there is a simple fee schedule:

The SBA – not the small business borrower – will pay the lender a processing fee based on the balance of the financing outstanding at the time of final disbursement in the following amounts:

- five percent for loans of not more than $350,000;

- three percent for loans of more than $350,000 and less than $2,000,000; and

- one percent for loans of at least $2,000,000

(see 15 USC s. 636(a)(36)(P)).

And the SBA Interim Final Rule has similar language to the Treasury Fact Sheet. At page 24 of the Interim Final Rule is this:

What fees will lenders be paid? SBA will pay lenders fees for processing PPP loans in the following amounts:

i. Five (5) percent for loans of not more than $350,000;

ii. Three (3) percent for loans of more than $350,000 and less than $2,000,000; and

iii. One (1) percent for loans of at least $2,000,000.

So this appears to be pretty simple: a loan up to $350,000 gets the lender a fee of 5% of the amount of the loan. A loan of more than $350,000 and less than $2,000,000 gets the lender a fee of 3%. And a loan of $2,000,000 or more gets the lender a fee of 1%.

Was that the intent?

So a PPP loan of, say, $350,000 gets the lender a fee of $17,500 (at 5%) and a loan of, say, $400,000 gets the lender a fee of $12,000 (at 3%)? Or did Treasury intend that a loan of, say, $500,000, would get the lender a fee of 5% on the first $350,000 and 3% on the next $150,000? Or for loans of, say, $4,000,000, the lender would get a fee of 5% on the first $350,000, 3% on the next $1,650,000, and 1% on the balance? If that was the intent, why didn’t Treasury write something like it had in 13 CFR §120.220, but for PPP loans:

- for loans up to $350,000, five percent of the loan amount;

- for loans from $350,000 up to $2,000,000, $17,500 on the first $350,000 and 3% on the balance of the loan amount; and

- for loans of $2,000,000 up to $10,000,000 (the maximum PPP loan), $60,000 on the first $2,000,000 and 1% on the balance of the loan amount

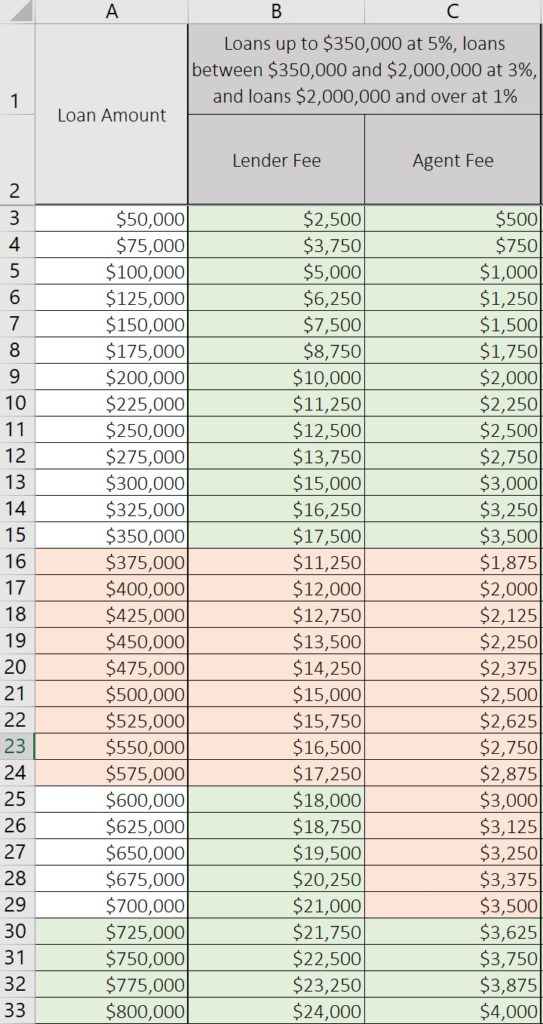

I did some calculations, and something interesting occurs. We get a range of loans where a lender will make less in fees even when lending out more money. Here’s what it looks like: for loan amounts up to $350,000, the lender gets a fee that goes up to $17,500. But for a loan just over $350,000 – and in this example I went up $25,000 – the lender makes over $6,000 less in fees. As can be seen, there is a “Dead Zone” of PPP loans between $350,000 and $600,000 where the lender makes less in fees than if it loaned $350,000 or less. And the PPP Loan Dead Zone is even broader for Agents: that zone extends from $350,000 to $700,000.

I did some calculations, and something interesting occurs. We get a range of loans where a lender will make less in fees even when lending out more money. Here’s what it looks like: for loan amounts up to $350,000, the lender gets a fee that goes up to $17,500. But for a loan just over $350,000 – and in this example I went up $25,000 – the lender makes over $6,000 less in fees. As can be seen, there is a “Dead Zone” of PPP loans between $350,000 and $600,000 where the lender makes less in fees than if it loaned $350,000 or less. And the PPP Loan Dead Zone is even broader for Agents: that zone extends from $350,000 to $700,000.

(there is also an Agent fee that follows the same ranges as the lender fee, only in amounts of 1%, 0.5%, and 0.25%).

And a similar PPP Loan Dead Zone occurs at the next step-drop in fees – for loans of $2,000,000 or more, the lender fee is 1%. So a lender will make less on a $6,000,000 PPP loan than it would make on a $1,950,000 loan. The high dollar PPP Loan Dead Zone for Agents is $2,000,000 to $4,000,000.

Could this fee structure create some misaligned incentives for lenders? Could a lender somehow “encourage” those $575,000 loans to become $650,000 loans, even if the borrower has only applied for $575,000? Could a lender process a $350,000 loan – with a $17,500 fee – before it processes a $400,000 loan – with a $12,000 fee?

So where does that leave us? As I wrote in my last article, nobody knows. As Yogi Berra once said,

It’s tough to make predictions, especially about the future.

So how can Treasury eliminate the PPP Loan Dead Zone?

Treasury can change the fee structure to something like this:

- for loans up to $350,000, five percent of the loan amount;

- for loans from $350,000 up to $2,000,000, $17,500 on the first $350,000 and 3% on the balance of the loan amount; and

- for loans of $2,000,000 up to $10,000,000 (the maximum PPP loan), $60,000 on the first $2,000,000 and 1% on the balance of the loan amount

With that, there are no PPP Loan Dead Zones … the larger the loan, the greater the fee. Fair enough, let’s get these loans processed!